According to insurance and reinsurance broking group Aon, global insured natural catastrophe losses in 2024 are likely to exceed the level seen in 2023, with the total already estimated to be above $102 billion.

It’s another costly year for the global insurance industry, but Aon noted today that many events failed to reach reinsurance attachment points.

The broker explained, “Most of the losses, including those from severe convective storms (SCS) as the costliest peril overall, continued to be retained by insurers, prolonging the period of exceptional returns for reinsurers.”

Aon’s latest report is only looking at data for the first nine months of 2024, so hurricane Milton is not included.

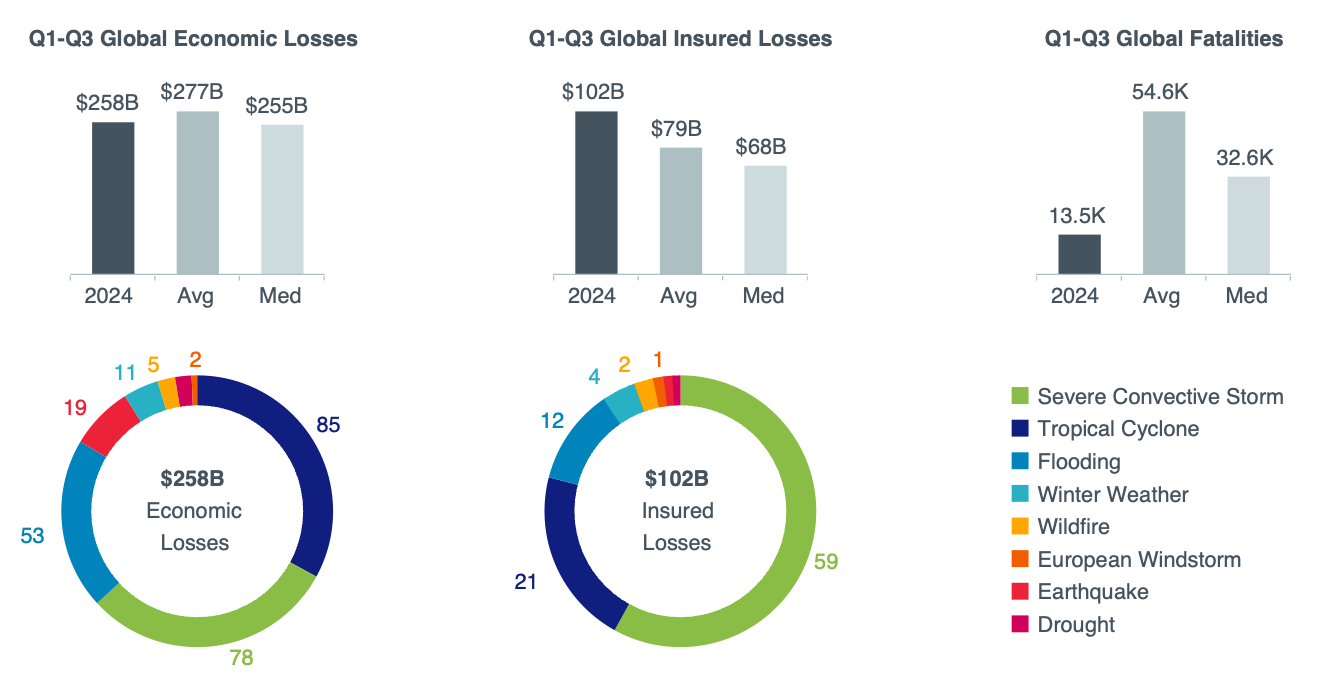

Aon counted 280 notable global natural disaster events in the Q1-Q3 period this year, which it estimates has resulted in economic losses of at least $258 billion and insurance market losses of $102 billion.

With hurricane Milton to add and any additional catastrophe or severe weather events through the rest of the year, Aon said this “likely result in total annual insured losses above those seen in 2023 ($125B).”

Aon’s data suggests an insurance protection gap of 60 percent, which it explains is one of the lowest on record.

The broker said this is, “mainly due to the higher contribution of insured losses in the United States, where insurance penetration is relatively high compared to other countries.”

Severe convective storms (SCS) are estimated to have driven $59 billion of the insurance industry catastrophe loss for the first nine months of 2024.

Aon said, “2024 is now the second consecutive year with over $50 billion in SCS-related insured losses. Remarkably, outside of 2023, no other years feature total annual insured losses from SCS events reaching even $45 billion.”

Aon also highlighted the costly year for catastrophe losses in Canada, saying the country is, “enduring its costliest insurance loss year on record, with the majority of the impact occurring as a result of four events within one month in Q3, with expected payouts exceeding $5.9B.”

Michal Lorinc, head of catastrophe insight at Aon, commented, “Our latest study highlights the complexity of natural catastrophe risk management for organisations, necessitating a myriad of resources around physical measures, warning systems, forecasts, and public awareness. The insurance industry has again played a significant role in this process, with re/insurance covering a high proportion of the global losses so far this year relative to previous periods.”

Aon’s estimate can be compared to one from reinsurance broker Gallagher Re, which recently reported that global publicly and privately insured catastrophe losses reached US $108 billion after the third-quarter of 2024.

English (US) ·

English (US) ·