Fast-moving wildfires in Southern California are causing what officials warned might be devastating losses for residents in the area. During a press conference on Tuesday, the state's Governor Gavin Newsom said that "not a few" but "many structures" in the area were destroyed by the blaze.

While the full impact of the fires—which have not been contained as of Wednesday early morning—is yet to be estimated, there's reason to believe many residents will face hundreds of thousands of dollars in damages. But in some neighborhoods affected by the fires, a major insurer canceled thousands of policies only last summer—leaving homeowners scrambling to find coverage when they need it the most.

Newsweek contacted insurance firm State Farm and actor James Woods, an affected resident who addressed the issue on X, for comment by email on Wednesday early morning, outside of standard working hours.

Why It Matters

While California is naturally a wildfire-prone area, multiple recent studies have found that climate change is making wildfire season in the state longer while also increasing the fires' frequency and the total extent of areas they burn, the U.S. Environmental Protection Agency (EPA) has reported.

However, the rapid increase in the frequency and intensity of wildfires in the Golden State is having a dramatic impact on its property insurance market, with several private insurers cutting coverage in some of the most at-risk areas in recent years. This, in turn, has left many California homeowners with limited options for coverage, scrambling to get insurance at a time when they need it most.

Every new wildfire season brings the risk that the ongoing crisis in the California property insurance market might worsen unless action is taken to encourage insurers to write more policies in risky neighborhoods.

What To Know

Three fires—Palisades, Eaton and Hurst—are currently raging in Southern California, spurred by strong winds.

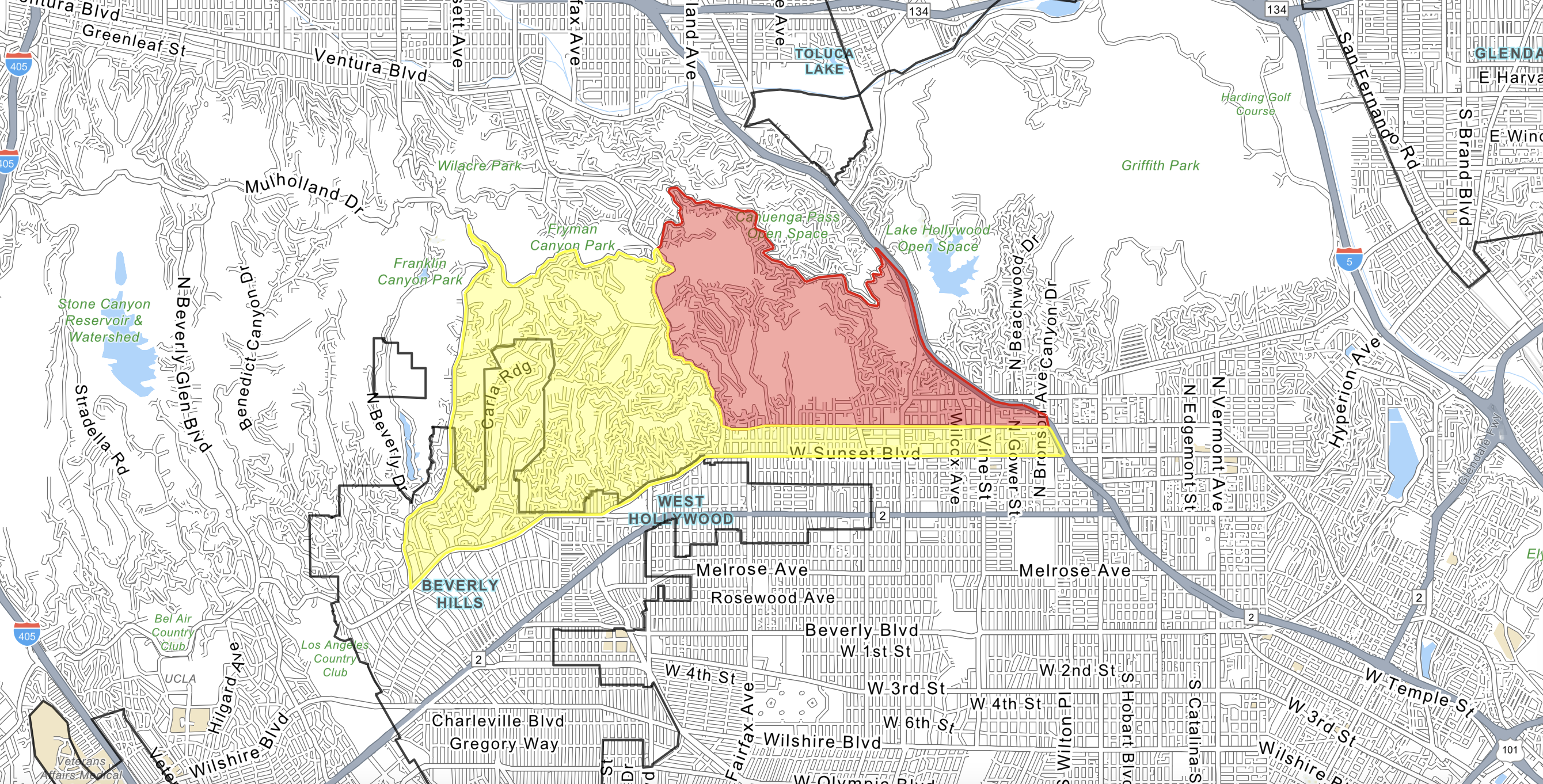

According to the Los Angeles Fire Department, the Palisades fire started on Tuesday morning in the affluent Pacific Palisades neighborhood. Strong winds reaching at least 40 mph helped the flames spread quickly, and by Tuesday night the fire had burnt 2,900 acres and forced at least 30,000 to evacuate.

The Eaton fire started on Tuesday evening near Pasadena, in Eaton Canyon, and burned at least 1,000 acres by later in the night, according to the Angeles National Forest.

A third fire, Hurst, was reported burning near San Fernando on Tuesday evening, according to authorities. Angeles National Forest wrote on X later that night that the fire had spread across approximately 500 acres.

As of Wednesday early morning, the fires were still out of control.

How Many People Are Insured in Areas Affected by the Fires?

Getting fire insurance has become more difficult in the past three years as several insurers have paused or cut coverage in parts of the state, with many citing the growing risk of wildfires as their main reason for doing so. Because of its often unpredictable wind conditions, Los Angeles is an at-risk area.

In April 2024, State Farm—one of the biggest private insurers in the state—announced that it had canceled a total of 72,000 policies in California, 30,000 of which were homes. Many of those affected lived in high-risk, upscale neighborhoods in Los Angeles County, the area now affected by the Palisades fire.

The move was justified by State Farm as an attempt to reduce the company's overall exposure after two years of devastating wildfires in 2017 and 2018, and huge losses for the insurance industry in California.

In Pacific Palisades, about 1,600 insured homes lost coverage following State Farm's decision, as reported by ABC 7.

While state law does not require California homeowners to have fire insurance, most mortgage lenders do, so it is likely that those who have obtained a loan to purchase their home have fire coverage.

Residents of high-risk areas who cannot find fire insurance in the traditional market can apply for the state's FAIR Plan, which works as an insurer of last resort. Unlike Florida's state-backed Citizens Property, California's FAIR Plan is a private association whose day-to-day operations are controlled by insurance companies and not taxpayers.

Its size has grown in recent years: while in 2020 it covered less than 3 percent of residents in the state, the insurer has more than doubled its policies since then, reaching a total of 452,000, as reported by CapRadio.

While it is likely that most homeowners in areas affected by the Palisades and Eaton fires have fire insurance, there have been reports of California homeowners going without coverage after being unable to find affordable options.

Last year, CNN reported that a family who had gone through the deadly 2018 Camp fire and moved to northern California, only to have their new home burned down by the 2024 Park fire, did not have fire insurance because they had been priced out of the market.

What Damages Does Fire Insurance Cover?

Most standard homeowner insurance policies cover fire damages, including those caused by wildfires, according to Bankrate. In the case of wildfires, dwelling coverage will cover the cost of rebuilding the physical structure of the home and replacing any damaged parts.

However, wildfire damage may not be included for residents who live in high-risk areas. California's FAIR Plan offers the Golden State's property owners in high-risk zones an option for coverage–though it is often more expensive than the traditional market.

Under a new regulation passed in December last year, insurance companies in California will be required to offer coverage to homeowners in wildfire-prone areas. The move is an attempt to prevent insurers from cutting coverage in the most at-risk zones in the state.

What People Are Saying

Rick Saxton, an X user from Wyoming, said on the platform: "Doesn't look good for those who live there. I'm wondering if insurance companies will treat them better than those that got flooded out and lost their homes in the east US, Appalachia area?"

Actor James Woods, a resident of Palisades, responded: "Actually one of the major insurance companies canceled all the policies in our neighborhood about four months ago."

What's Next

It is not yet clear what damage will be caused by the fires burning in Southern California. By the end of 2024, a total of 8,024 wildfires had burned 1,050,012 acres of land across the state and killed one person, according to the California Department of Forestry and Fire Protection.

Significant losses will run the risk of exacerbating the ongoing property insurance crisis in the Golden State, likely pushing the cost of premiums up in vulnerable areas.

English (US) ·

English (US) ·