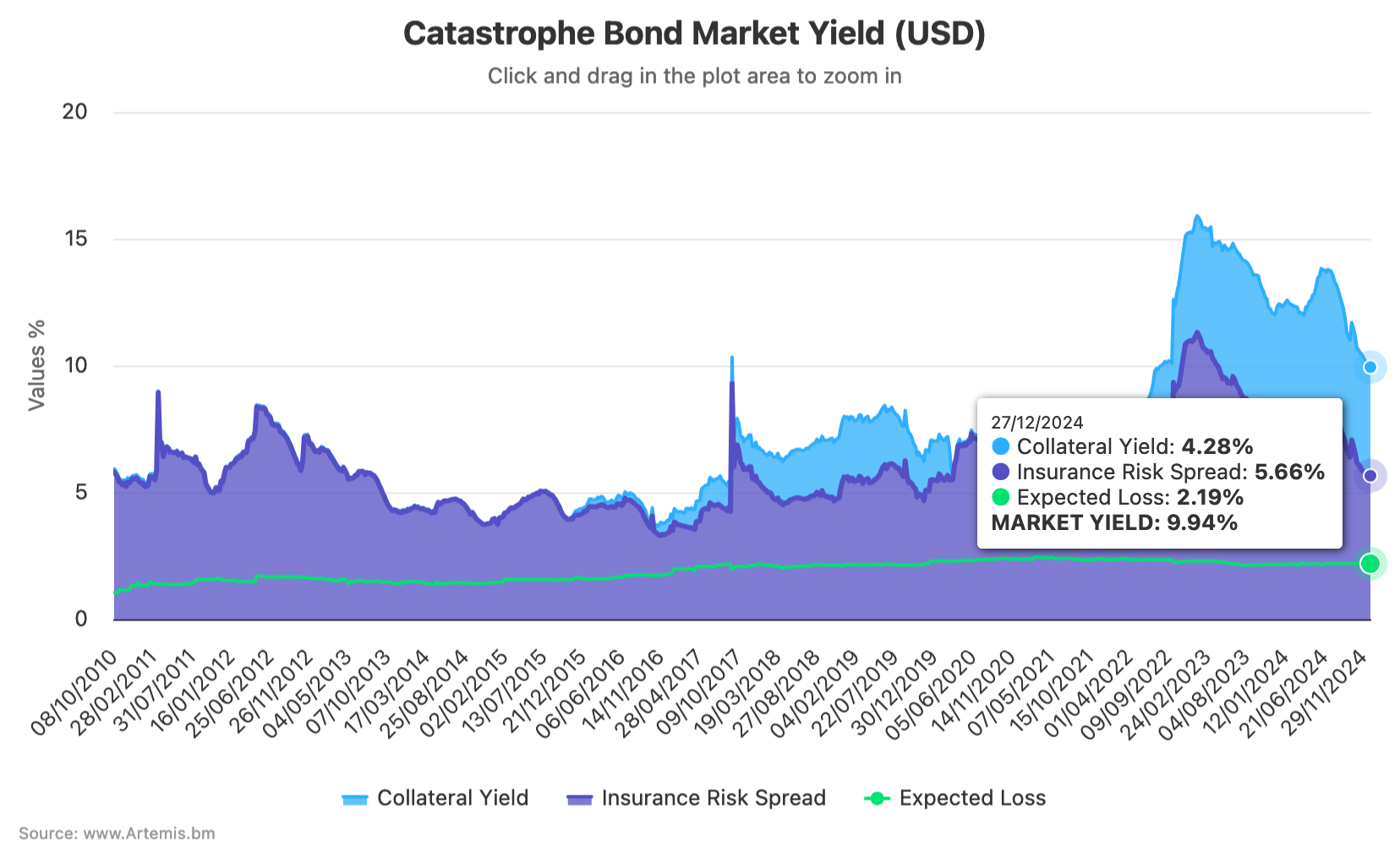

High-demand for catastrophe bond investments has compressed risk spreads somewhat, resulting in the overall yield of the catastrophe bond market falling back into single digits at 9.94% by the end of December 2024, according to the latest data from Plenum Investments.

The catastrophe bond market yield had demonstrated typical seasonal traits through the Atlantic hurricane season, but then continued to decline as market activity ramped up with a busy issuance pipeline, which was met by strong investor appetites for new cat bond investment opportunities.

This decline in yields has continued through December, the latest data shows, resulting in the overall yield of the catastrophe bond market falling back into single digits.

As of December 27th, the latest cat bond market yield data currently available, the overall market yield stood at 9.94%, with continued compression of the insurance risk spread component and a slight decline in collateral yields the drivers.

This catastrophe bond market yield data has been collated with the assistance of our kind partner Plenum Investments AG, a specialist insurance-linked securities (ILS) investment manager.

The decline in yields through December is indicative of the softened marketplace we currently see, as demand has been particularly high, while significant maturities coming are delivering cash to be recycled back into the catastrophe bond market.

This has resulted in strong execution for sponsors, but reduced return multiples on new cat bond deals for investors. Although, the yield of the catastrophe bond market still remains elevated by historical standards as our chart shows.

The last time the yield of the cat bond market fell below 10% was in August 2022.

But and perhaps more notably, with the insurance risk spread component currently 5.66%, the last time the cat bond market saw it that low was back in early February 2022.

The compression of risk spreads in the catastrophe bond market is also visible in two of our other charts.

This chart that tracks average expected loss and spreads of cat bond & related ILS issuance by year and quarter, and also this chart that tracks the average multiple (expected loss to spread) of cat bond & related ILS issuance by year and quarter.

Using those two charts and our visualisation of cat bond market yields over time, you can get a very clear picture of price and deal execution dynamics in the marketplace over time.

It’s going to be interesting to watch the direction catastrophe bond market yields travel in over the coming months, as with significant cat bond volumes set to mature (which you can track in this chart) capital for new cat bond deals will be abundant, so strong price execution is likely to persist as a feature of the market.

Plenum Investments commented that, “We assume that the market return will continue to weaken slightly due to the strong demand for CAT bonds.”

Analyse catastrophe bond market yields over time using this chart.

English (US) ·

English (US) ·