President-elect Donald Trump's election win is likely to have "significant implications" and "raises questions" for funding for the Social Security program, experts have told Newsweek.

Republican Trump will become the 47th president following his decisive defeat of Democrat Kamala Harris on November 5. Among his campaign pledges, Trump promised to nix taxes levied on Social Security income, which is paid by around 40 percent of current recipients, according to the Social Security Administration (SSA).

Under current rules, individuals who have an income between $25,000 and $34,000 per year are subject to taxes on up to 50 percent of their Social Security income. If they earn more than this, as much as 85 percent of benefits can be subject to tax.

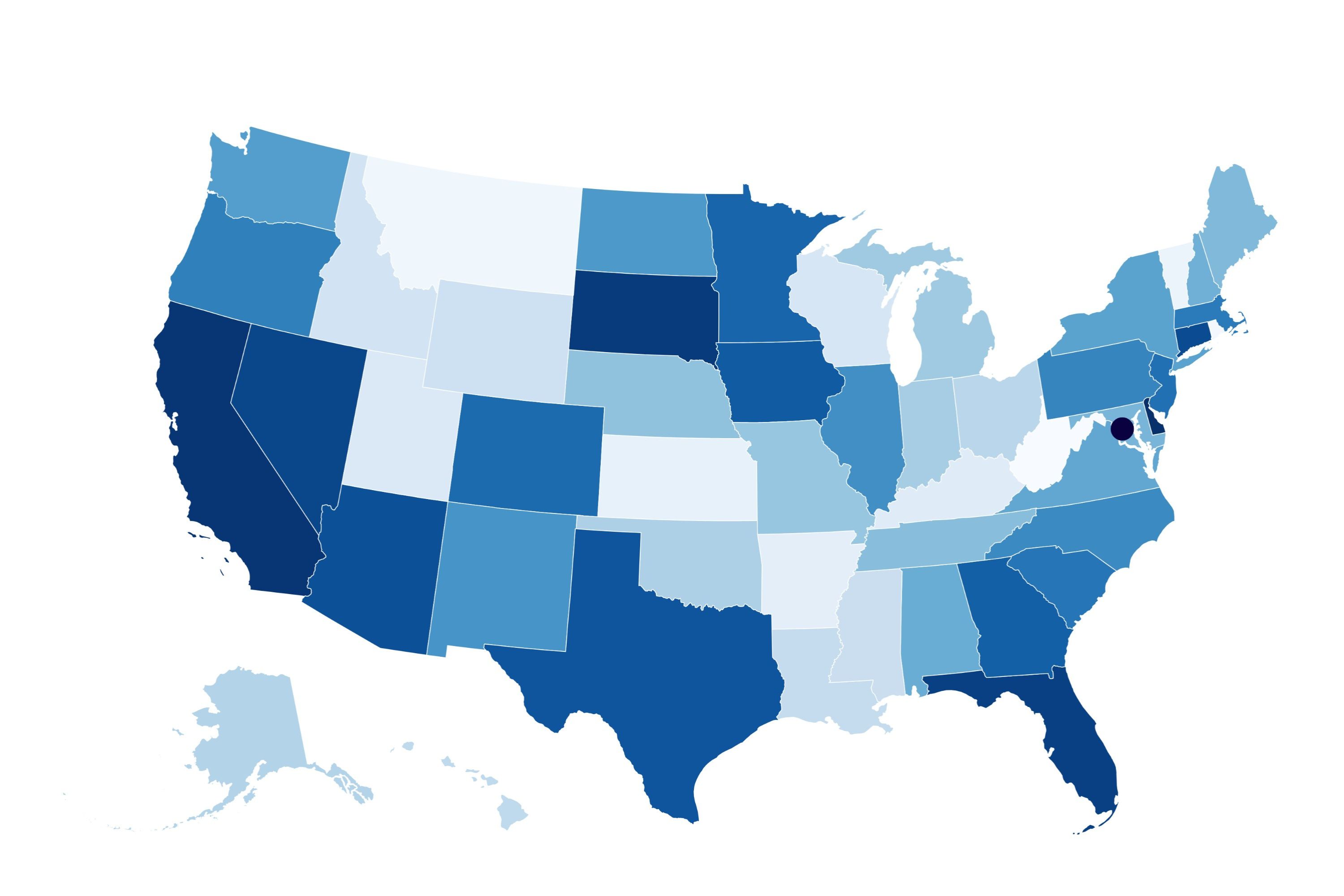

While the pledge will put more money in the pockets of beneficiaries in the short term, experts have warned that it could impact Social Security's funding coffers. The SSA's 2023 Trustees Report released earlier this year found that trust funds that shore up the country's largest benefit system for retirees, survivors of deceased workers and disabled people is due to run out of funds in 2035.

By then, recipients are projected to receive only 79 percent of their full benefits unless action is taken by Congress to ensure its solvency.

"This Trump win could have significant implications for Social Security," Cliff Ambrose, founder and wealth manager at Apex Wealth, told Newsweek. "His proposed tax cuts, aimed at reducing payroll taxes, could further strain the Social Security Administration's funding, as payroll taxes are a primary funding source for Social Security benefits."

According to research conducted by the Committee for a Responsible Federal Budget (CRFB) in October, Trump's policies—including ending taxes on Social Security income and tips, imposing tariffs and accelerating the deportation of undocumented migrants—would escalate Social Security's cash shortfall over the next decade by $2.3 trillion, accelerating the program's insolvency to 2031—three years sooner than previously forecasted.

The think tank estimated that nixing income taxes on Social Security benefits could result in approximately $950 billion in revenue loss for the SSA.

"The so-called experts at CRFB have been consistently wrong throughout the years. President Trump delivered on his promise to protect Social Security in his first term, and President Trump will continue to strongly protect Social Security in his second term," Karoline Leavitt, Trump campaign national press secretary, told Newsweek.

"Without a strategy to replenish or secure funding, these cuts might accelerate the need for reforms like reducing benefits, adjusting the retirement age, or increasing eligibility requirements," Brandy Burch, CEO at benefitbay, told Newsweek.

Ambrose agreed that Trump will need to address the incoming shortfall to avoid a benefit cut: "The outcome of Trump's proposals would largely depend on whether alternative funding solutions accompany these tax changes."

English (US) ·

English (US) ·