The vast majority of Americans believe now is a bad time to buy a home, according to a new survey.

The University of Michigan's consumer sentiment survey on attitudes toward buying conditions for houses showed that in October, 82 percent said it was not a good time to buy a house currently. The poll asked 948 respondents to answer the question: "Generally speaking, do you think now is a good time or bad time to buy a house?"

That sentiment has been pervasive throughout much of 2024, the data shows. In October 2023, 77 percent of those surveyed said it was a bad time to purchase a home, with this rate climbing to a peak of 88 percent in August this year.

Commenting on the findings, the real estate expert and CEO of Reventure, Nick Gerli, said on X, formerly Twitter, that the "pretty crazy" statistic demonstrates that at present, this is the "most pessimistic homebuyers have ever been about the housing market."

Pretty crazy stat.

82% of Americans say it's a bad time to buy a house in late 2024.

That's the most pessimistic homebuyers have ever been about the housing market.

Helps explain why homebuyer demand is so low. pic.twitter.com/hMmLB5nPXj

"There is a massive amount of inertia right now. And it all has to do with cost and affordability," he continued. "Most buyers simply cannot afford to pay the prices and mortgage payments in today's market."

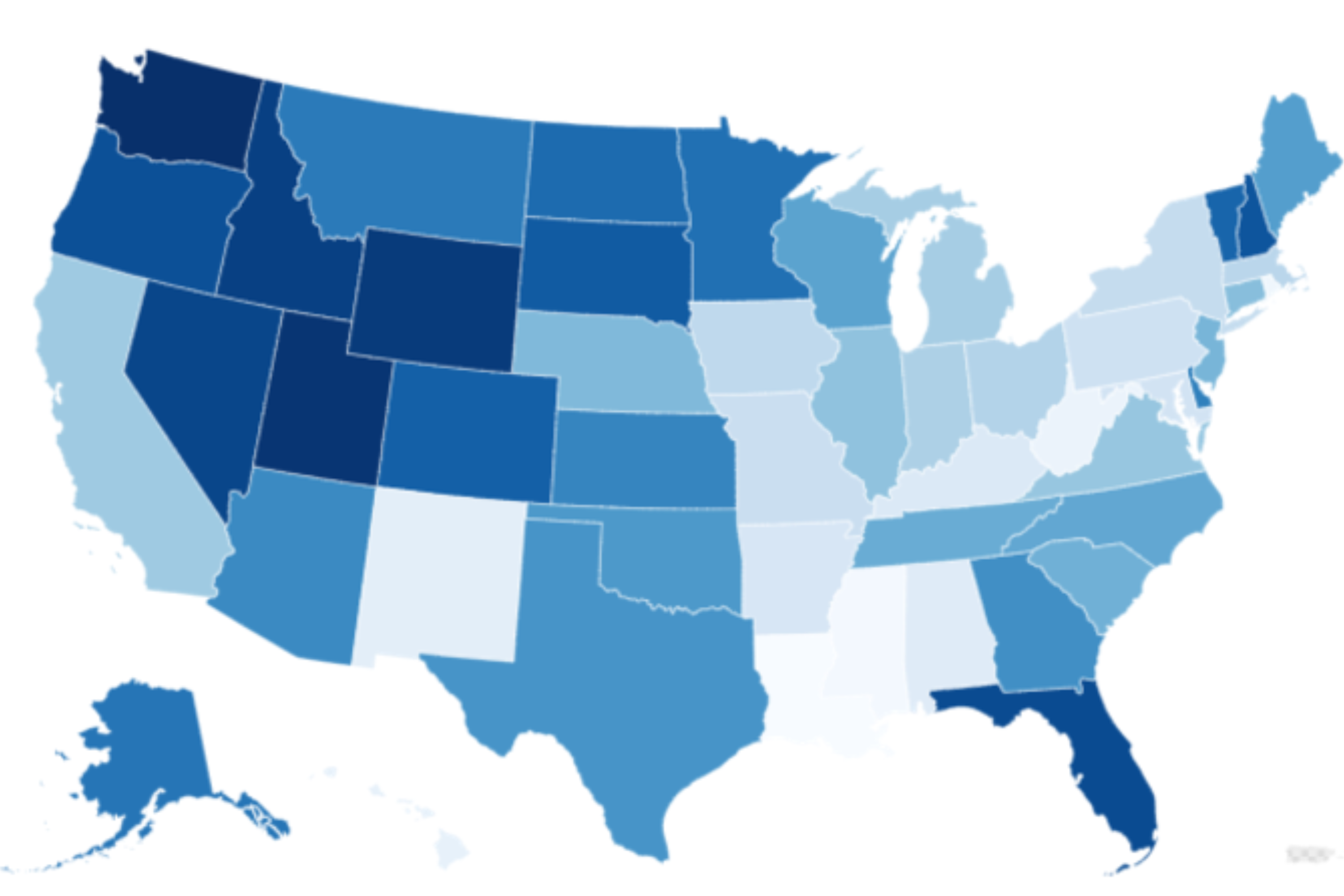

Gerli explained that historically when mortgage rates become high, negative sentiment around home buying increases. While benchmark interest rates have been cut by the Federal Reserve, mortgage rates remain stubbornly high at a time when people are struggling with surging inflation and the cost of living crisis. Although mortgage rates have been much higher at times in the past, more people are now feeling pessimistic about home purchases than ever before.

"High nominal home prices are having a huge impact on deterring buyers from the market," Gerli continued. "People don't really care about marginal swings in mortgage rates. They also don't really care that their income has grown the last five years. They are still stuck on the fact that a house that looks like it should be $400k is priced at $600k. And they can't get over it."

The affordability of homes in the U.S. has become a significant issue in recent years. The current median house price in the U.S. for the third quarter of 2024 is $420,400, according to the St. Louis Federal Reserve Bank - up more than $100,000 on $317,100 in the second quarter of 2020.

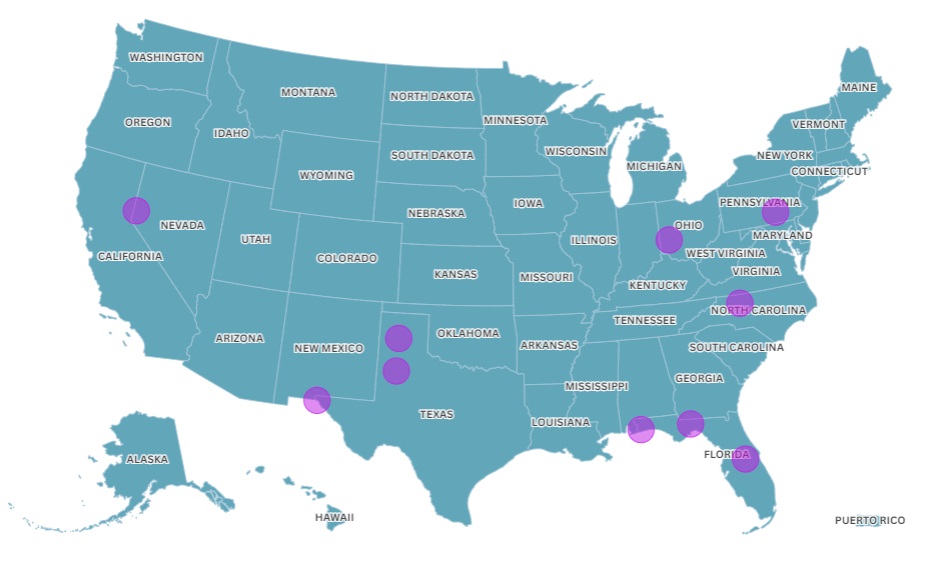

Higher prices correlate with a dip in home sales. Data from the National Association of Realtors shows that existing home sales are currently lower than the peak during coronavirus lockdowns in May 2020. In October 2024, there were 3,960 completed sales across the U.S., compared to 4,090 in May 2020.

Existing home sales have also dropped off considerably since January 2022, when 6,430 sales went through. A year later in January 2023, this had dropped to 4,070. While there have been peaks and troughs in the number of homes sold since then, sales have not recovered to above the 5,000 sales per month mark that was common prior to the pandemic.

English (US) ·

English (US) ·