Mark-to-market pricing implied losses to the catastrophe bond market from hurricanes Helene and Milton are estimated at ~$380 million, at which level actual losses to the cat bond market in 2024 are running below the expected level, suggesting pricing will remain in neutral territory or could even soften slightly for the January renewals, according to Lane Financial LLC.

Specialist insurance-linked securities (ILS) consultancy Lane Financial has analysed the mark-to-market effects of recent hurricane Helene and Hurricane Milton, looking at how this has changed the implied pricing in the marketplace.

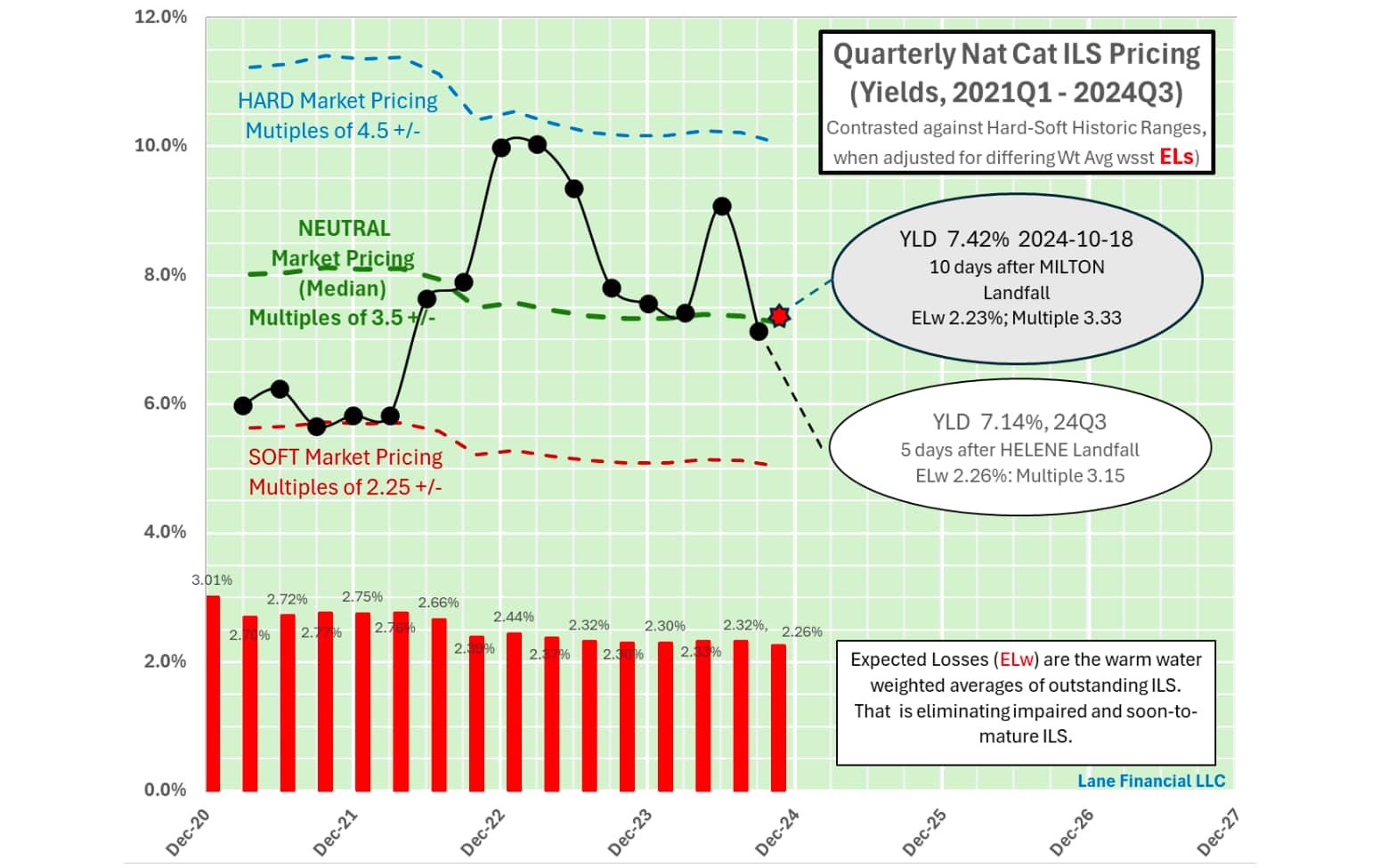

“The late season strike of Hurricane Helene and Hurricane Milton in Florida could have caused ILS prices to return again to HARD market pricing seen in the first quarter of 2023. But like Ian in 2022, the hurricane tracks turned at the last moment to make landfall away from the most property rich part of the coast (Tampa, Clearwater, and the Tampa Bay area),” the consultancy explained. “The two hurricanes caused significant, but manageable, losses for the reinsurance market and the ILS market. Prices are at neutral levels and absent any further natural catastrophes before year end, we expect them to stay neutral or soften further for January renewals.”

Lane Financial also notes that external factors also have an influence on the relative strength of pricing in the catastrophe bond and ILS market.

Saying, “It should be noted that this is not only because of manageable losses in the ILS market but also because of compressed spreads in the US corporate bond market. ILS yields tend to float in the zone between High Yield debt and Investment Grade debt. Compression of US corporate spreads, caused by feelings of no- landing or soft-landing scenarios for the economy, will spill into the ILS market as investors search for yield.”

But, the internal dynamics of the ILS market tells the story and Lane Financial’s analysis of multiples shows that secondary market pricing are “back in the neutral zone,” despite the visits of Helene and Milton.

Investors could have expected losses of $790 million to the catastrophe bond market in 2024, Lane Financial’s analysis of expected losses suggests.

But, based on secondary market price moves, hurricane Helene added perhaps $55 million of estimated loss to cat bonds, based on end of Q3 data, while more recent hurricane Milton added more.

“As of Oct 20 the implied ILS- estimate of loss caused by the two storms was $380 Mn. Allowing for modest losses earlier in the year – perhaps due to aggregate creep and loss development and rounding up for further loss development – say to $500 Mn. for the year – it is still is below expectations. Hence prices will stick in neutral, or soften, absent new Catastrophic events,” Lane Financial concludes.

It should be noted that these remain mark-to-market implied estimates of potential losses to the catastrophe bond market at this time and as we all know, implied losses can go up as well as down.

The image below, taken from Lane Financial’s latest trade note, shows cat bond market implied price trends in the black line with dots, plotted against where typical hard, neutral and soft market multiples have sat.

You can see the implied pricing of the market did tick up slightly with Milton, but not significantly by any means.

As actual losses the catastrophe bond market are running below those implied as being expected, by the issuance expected loss metrics, it suggests no immediate return to a hard market state.

The question now is where in the range between hard, neutral and soft cat bond market implied pricing might settle to over the coming weeks, as seasonality from the wind season runs out, issuance picks up and potential capital inflows are seen again.

)

English (US) ·

English (US) ·