In announcing its third-quarter results at end of day yesterday, US insurer Allstate also provided an insight into the losses it expects from recent hurricane Milton and at the level disclosed, it appears that the lowest of the carriers Florida focused Sanders Re catastrophe bonds could trigger and pay out, Artemis can report.

With hurricane Milton a Florida only event it brings into focus the reinsurance tower Allstate specifically has in place for its Castle Key underwriting entities in the state.

With hurricane Milton a Florida only event it brings into focus the reinsurance tower Allstate specifically has in place for its Castle Key underwriting entities in the state.

As we reported at the time of its issuance, this year Allstate sponsored a zero-coupon catastrophe bond that sits close to the bottom of that reinsurance tower.

The $74.5 million Sanders Re II Ltd. (Series 2024-2) cat bond was relatively privately placed and featured a single tranche of zero-coupon notes, that provide Allstate with multi-peril catastrophe reinsurance protection for the state of Florida over a one-year term.

This was a particularly risky catastrophe bond sponsored by Allstate, likely why it ended up being priced more privately and in zero-coupon note form, as from issuance we understood the expected loss of the notes to be 16.32%.

The zero-coupon notes were initially priced just below 50% of par, we understand, reflecting the fact this tranche of Sanders Re cat bond notes were perhaps the riskiest ever issued.

Now, Allstate CEO Tom Wilson said yesterday that, “Hurricane Milton impacted customers shortly after the quarter with estimated losses of approximately $100 million.”

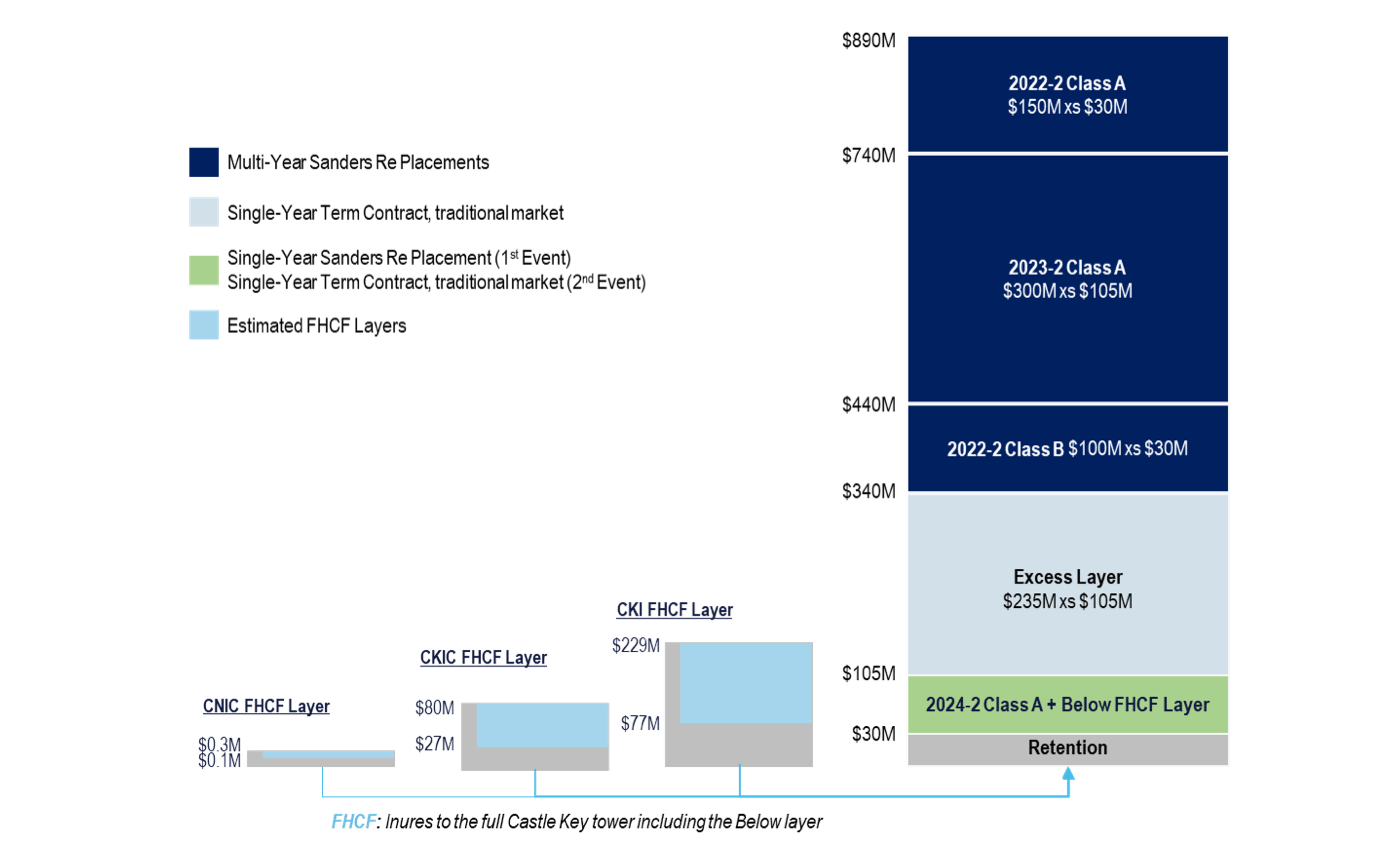

Those losses would be expected to only qualify under the Florida reinsurance tower, for the Castle Key entities, which you can see below.

You can see the Sander Re 2024-2 zero coupon catastrophe bond, sitting towards the bottom of the main reinsurance tower, above a $30 million retention.

The cat bond provides Allstate with first-event reinsurance protection in that layer attaching at $30 million of losses and exhausting at $105 million.

So, on the basis of hurricane Milton being a $100 million loss to Allstate, it seems clear that cat bond is at-risk of paying out now.

It’s worth noting that Allstate’s CEO did not clarify whether the $100 million Milton loss estimate was gross or net, but given the low $30 million retention it would seem likely to be a gross cost of claims estimate at this time.

Which suggests the hurricane Milton loss might not reach into the first excess-of-loss layer of reinsurance above the cat bond, which we understand from sources also has some collateralized market participation.

We’ve also learned that the $74.5 million of Sanders Re 2024-2 cat bond notes have been heavily marked down in the secondary market, with them priced at as low as for bids of 5 cents on the dollar.

Remember though, these are zero-coupon and were priced below 50 at the start of their life, so at that level it suggests the market is anticipating a roughly ~90% loss of principal is possible at the outside right now.

This is the first clear sight of a catastrophe bond that looks to be particularly exposed to losses from Milton. But given the high-risk nature of this tranche, it’s perhaps no surprise that any significant hurricane event in Florida might have triggered it.

We’ve added this Sanders Re 2024-2 issuance to our Directory of catastrophe bonds facing losses, deemed at risk, or already paid out.

You can read all about this Sanders Re II Ltd. (Series 2024-2) from Allstate and every other catastrophe bond issuance in the extensive Artemis Deal Directory.

)

English (US) ·

English (US) ·