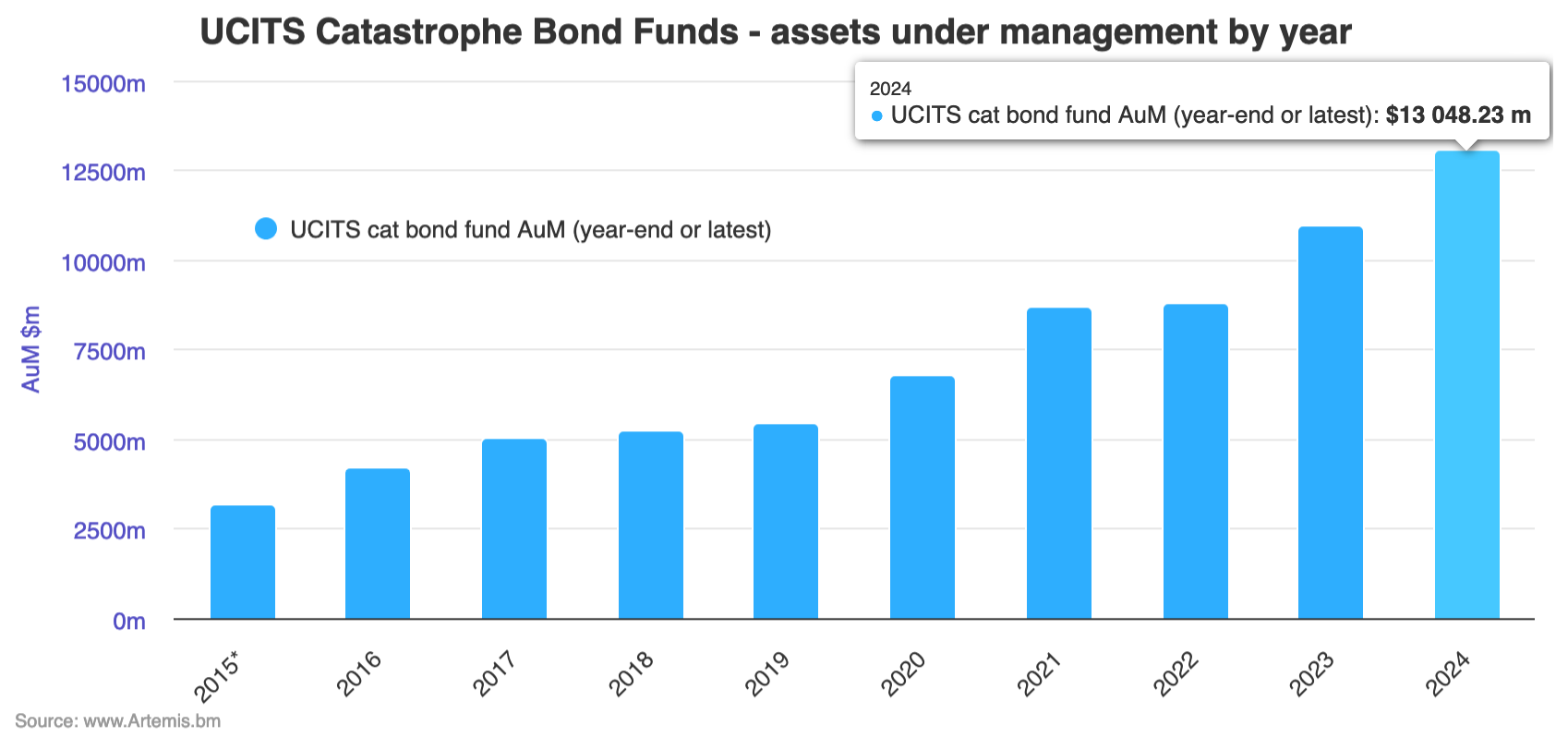

Catastrophe bond funds in the UCITS format grew strongly in recent months, adding approximately 7% in assets during the third-quarter of 2024 to take their combined assets under management to a new record high of almost $13.05 billion.

It is the first time that the group of UCITS catastrophe bond funds has surpassed $13 billion in combined assets, with more than $840 million added to their combined AUM over the three months to September 30th this year.

UCITS cat bond fund strategies have grown very strongly in 2024, with combined AUM growing 19% from just over $10.94 billion at the end of 2023, to their new $13 billion high.

The combined assets of the now 16 UCITS cat bond fund strategies is now some 49% higher than it was at the end of 2022.

As a result, these UCITS investment fund strategies have been providing an increasing share of risk capital to support the outstanding cat bond market in recent years.

Analyse UCITS catastrophe bond fund assets under management using these charts (data kindly shared by our partner Plenum Investments AG, a specialist insurance-linked securities (ILS) fund manager).

As of the end of September 2024, the three largest UCITS cat bond funds provide almost $9.26 billion of the total AUM, so around 71% of UCITS cat bond capital.

That percentage remains flat with the end of the first-half, reflecting the fact the majority of the 16 UCITS cat bond fund strategies have grown in recent months.

At the end of Q3 2024, the Schroder GAIA Cat Bond Fund strategy remains the largest and has now increased in size by 26% through this year so far, to reach almost $3.59 billion in assets.

The Twelve Cat Bond Fund is the next largest of the UCITS cat bond strategies, ending September at almost $3.16 billion, followed by the GAM Star Cat Bond Fund at $2.51 billion.

Both the Schroder GAIA and Twelve Cat Bond funds are now at their largest ever sizes, while the GAM Star Cat Bond has returned to growth in the last few months.

The 16 UCITS catastrophe bond fund strategies provide a range of risk-return profiles to investors and make up a significant proportion of capital deployed to the catastrophe bond market by their specialist managers.

It’s worth noting that as well as some new inflows of capital, the seasonal coupons earned by these cat bond funds will have also been a factor in their increasing assets under management.

With the catastrophe bond market pipeline now opening up as the Atlantic wind season draws to a close and the cat bond market yield remaining at a historically high level, we anticipate further AUM growth for the group of UCITS cat bond funds through the fourth-quarter of the year and into 2025.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

)

English (US) ·

English (US) ·