With mortgage rates ticking up and home prices still rising nationwide, Donald Trump will be inheriting the thorny problem of the U.S. housing market when he takes office on Monday.

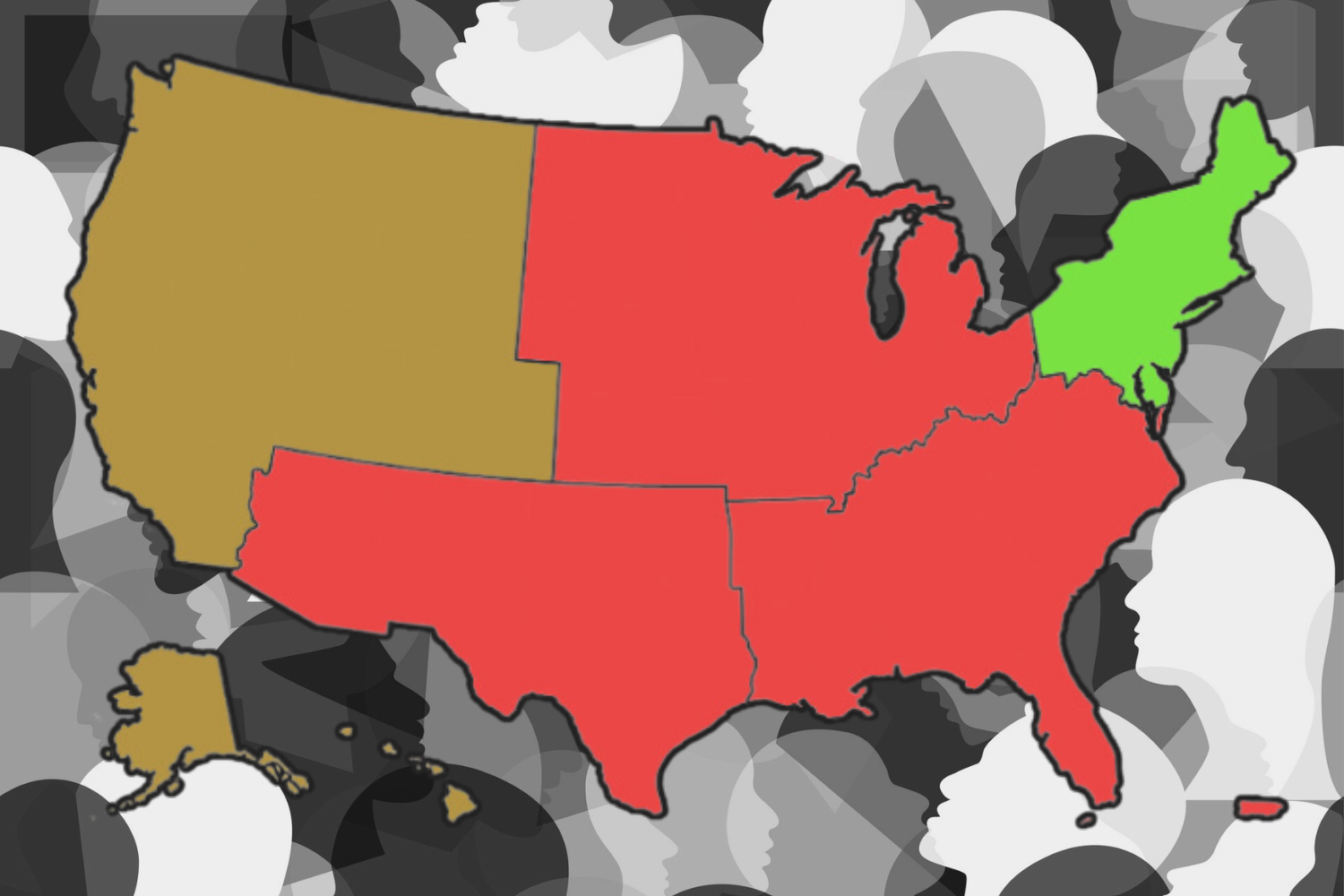

During the 2024 presidential race, he vowed to fix the country's chronic lack of inventory by opening more federal land for housing and by deporting millions of undocumented migrants whom he said were the main cause of the nation's housing crunch.

He also promised to bring down mortgage rates to make homebuying more affordable by slashing inflation—however experts fear that his plans might make inflation worse and further erode affordability in the housing market.

Why It Matters

Housing affordability was a big topic during last year's presidential race which ended with Trump's victory over Vice President Kamala Harris. Both talked a lot about how they would have addressed the ongoing crisis, with Harris promising to build millions of homes if elected and Trump vowing to increase inventory by slashing regulations and freeing homes occupied by illegal migrants.

As home prices remain near their pandemic highs and mortgage rates are expected to linger around the 6 percent mark throughout 2025 despite likely interest rate cuts by the Federal Reserve, homeownership will continue to be an unaffordable dream for many Americans this year. This, in turn, means that Trump will be under steady pressure to solve the ongoing crisis during his first year at the White House.

Trump's Plans—And How They Could Backfire

Taylor Rogers, a spokesperson for the Trump-Vance transition team, told Newsweek in a statement: "President Trump will deliver on his promise to Make Housing Affordable Again by defeating historic inflation and reducing mortgage rates."

She added: "President Trump will ban mortgages for illegal immigrants who drive up the price of housing, eliminate federal regulations driving up housing costs, open portions of federal land with ultra-low taxes and regulations for large-scale housing construction. The cost of new homes will be cut in half, and President Trump will end the housing affordability crisis."

However, according to Dan Hnatkovskyy, CEO of artificial intelligence (AI)-powered marketplace Jome, formerly NewHomesMate, there are "additional factors" in Trump's overall political agenda to consider that could affect housing affordability.

"Even though I think that making more land available and decreasing regulation is a positive thing for the market, some other policies may have a major negative effect on the housing market," he told Newsweek. "For example, tariffs on materials like lumber, much of which is imported from Canada, could drive up construction costs if tariffs increase."

Hnatkovskyy added: "Additionally, policies on migration and border control play a role. A portion of the construction workforce, especially in the South and Southeast, consists of undocumented immigrants. If stricter immigration policies are enforced, this could lead to a construction labor shortage, further complicating housing affordability."

Opening Up Federal Land and Cutting Red-Tape Regulations

Trump said he would increase much-needed inventory in the U.S. by opening up federal lands to enable more construction and by cutting red-tape and regulations that make it difficult for builders to build.

"For builders, lighter regulations could reduce construction costs and encourage them to undertake more projects, leading to increased housing supply and alleviating pressures on home prices," Cynthia Seifert, founder of real estate seller leads generator KeyLeads, told Newsweek.

Together, these policies "could help alleviate the housing supply crisis that has left the housing market under-supplied to the tune of 2.5 to 7 million homes, driving housing vacancy rates to low levels, limiting the number of homes available for sale, and contributing to high rents and home purchase prices," Danielle Hale, Realtor.com chief economist, told Newsweek.

But Hnatkovskyy said that the problem with opening up federal land is that a majority of it is in national parks and military bases, "and that's not where people actually want to live."

Another issue, he said, is the "not in my back yard" or NIMBY movement, with a lot of people living in single-family homes being unwilling to allow a different type of construction in their areas.

"Donald Trump said he'd protect single-family communities in the United States, but what the country needs is to push for more dense and more affordable housing," he said.

Increasing Inventory With Mass Deportations

Experts also worry that, if Trump implements all of his plans, there might not be enough workers left to build the new homes that the country needs so desperately.

"Restricting immigration could make it more difficult for companies to hire workers in the near-term, and that impact is likely to be acutely felt by a construction industry that employs many foreign-born workers," Hale said.

According to the most recent American Community Survey (ACS), the share of immigrants in construction was 25.5 percent in 2023, up from 24.7 percent the year before—the highest percentage on record.

"Immigration restrictions could lead to labor shortages in the construction industry, increasing costs and possibly slowing down project timelines," Seifert said.

On top of the harm that it might cause the construction sector, Hnatkovskyy thinks that deporting immigrants might not be a significant solution to the U.S. housing crunch.

"I don't think that illegal immigrants play a big part in the housing market, they don't have much purchasing power in the U.S.," he said. "I think that solution is overstated, but they're a much bigger force in terms of construction labor. Kicking out immigrants won't free up a lot of inventory, but I think that it'll make construction inevitably a lot more expensive from a labor standpoint."

Boosting the Economy and Slashing Inflation

Realtor.com's expectations for this year is that mortgage rates will gradually ease as monetary policy normalizes and the economy continues to grow. But "the longer-term outlook will depend on the policies that are ultimately adopted by the incoming administration and Congress," Hale said.

"Pro-growth policies are good for the economy and will tend to push mortgage rates higher, but rising incomes in this kind of environment will enable households and businesses to better navigate higher rates," she explained. "Large budgetary deficits or tariffs that push up inflation, however, could cause mortgage rates to increase without necessarily boosting incomes or economic growth and would likely be more challenging for businesses and households to navigate."

According to Seifert, "Trump's policies that aim to stimulate economic growth could cause inflation to increase, leading to higher mortgage rates—potentially offsetting some of the advantages of increased income."

Tariffs, in particular against Canada, could significantly harm the construction sector.

"To build a house, it typically costs around $250,000-$300,000," Hnatkovskyy said. "The cost of lumber—the total construction materials, framing, other parts of the house—is roughly 30 percent of the cost of the house. If the Trump administration plans to increase tariffs for Canadian lumber by 50 percent, that would make the cost of lumber for delivering the house higher by roughly 30-40 percent, which will increase the cost significantly."

He added: "And at the end of the day, the worst part is that that cost increase is going to be transferred to American households. That's definitely going to be a contributing factor to decreasing affordability."

Will the Housing Market Become More Stable or More Volatile?

Seifert said that "the housing market could become more volatile if higher interest rates and labor shortages slow house construction rates and increase borrowing costs."

"However, if deregulation and tax cuts stimulate enough economic growth and household disposable income, these factors could help to stabilize demand and balance the market," she added. "Ultimately, the direction will depend on how these policies unfold and the Federal Reserve's response to inflation and economic conditions."

English (US) ·

English (US) ·