A House GOP proposal for spending cuts incoming President Donald Trump could make to help fund his policy priorities in the early months of the new administration includes a line that will alarm many student debtors.

The document, reported by Politico, suggests a $200 billion to $330 billion saving could be made if Trump chooses to "end the student loan bailout".

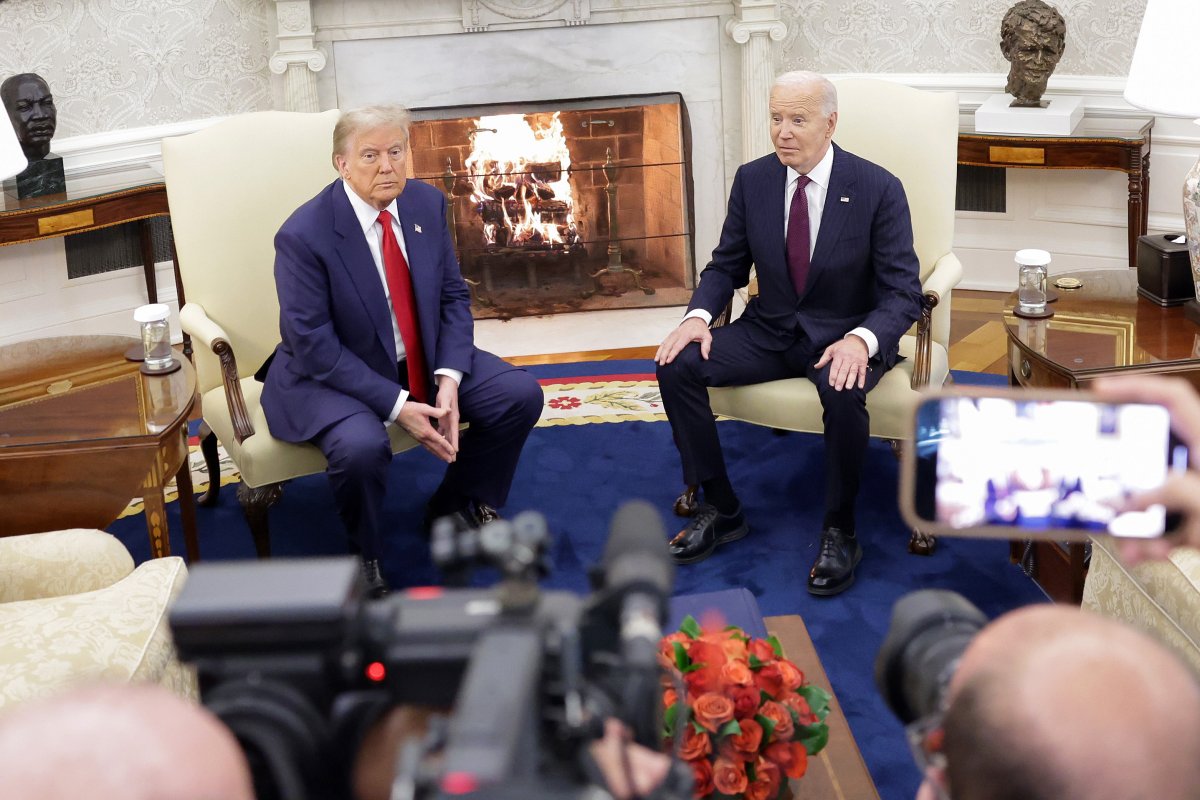

President Joe Biden prioritized student loan forgiveness during his term, introducing broad and contentious programs—challenged by his opponents in the courts—to relieve people of large chunks of their college debt.

Student loan repayments weigh heavily on the incomes of many Americans. While some see this debt as unduly large and argue the state should help to relieve it, others say it is the responsibility of the debtors to repay, not American taxpayers.

Trump has criticized the scope of Biden's student loan forgiveness. In a September presidential debate, Trump called it a "total catastrophe" and "all these students got taunted." His own plans for debt forgiveness are unclear.

With student loan forgiveness programs hanging in the balance, Newsweek asked two people on opposing sides of the issue to make the case for and against Trump keeping them. Here's what they had to say.

Braxton Brewington: Trump Should Cut Funds to Predatory Colleges, Not Student Loan Relief

More than five million hard-working people have had their crushing student debt burdens canceled over the course of Biden's presidential term, mostly for those legally entitled to relief from previously existing programs—some even signed into law by President George W. Bush—such as Public Service Loan Forgiveness (PSLF), Income-Driven Repayment (IDR) and borrower defense which enables cancellation for those defrauded and scammed by predatory schools.

For millions of everyday teachers, nurses, firefighters, and veterans, this has meant life-changing economic stimuli, enabling working-class people to buy their first home, find the financial resources to build a business, start a family, or live a life of dignity as they age.

But with an incoming hostile Trump administration—whose House GOP allies have proposed making $200 billion to $330 billion worth of cuts to "end the student loan bailout"—these ongoing efforts to administer financial relief for 40 million more student debtors will face stark pushback and significant obstacles.

It's no surprise Trump's rhetoric on student debt relief is as aggressive and regressive as it is.

His first term went terribly for student debtors of all stripes as his Secretary of Education Betsy DeVos worked overtime to prevent debtors from obtaining their relief—despite court-mandated instruction to administer it.

Pulled straight from the playbook of other moneymaking schemes, Trump oversaw the now-defunct "Trump University", a scam that offered no degree, had no accreditation, and preyed upon the elderly.

Today, Trump and his billionaire benefactor(s) profess a desire to cut "wasteful" spending through various cost-cutting means like the Department of Government Efficiency (DOGE).

But Republicans and elected officials actually opposed to "wasteful" spending wouldn't be so quick to make cuts to student debt relief programs.

When single mothers and veterans—the folks disproportionately being taken advantage of and scammed by these predatory for-profit colleges for which most of the cancellation accounts—get their debts rightfully canceled, it doesn't cost the government money.

In fact, the federal government is practically throwing cash in an incinerator by handing over blank checks to these predatory schools to begin with, only for courts to mandate debt elimination on the backend or borrowers driven into poverty by the schools rendered unable to pay back a penny.

If Trump and Republicans were serious about gutting "wasteful spending," they would start by cutting funding to predatory colleges who leech off the federal government and hold debtors hostage along the way.

The only reason to not do this? To continue padding the pockets of members of Congress who profit off of this type of pain.

The reality is, the political opposition to canceling student debt isn't rooted in unfair bailouts to people who otherwise have the means to get by. Quite the opposite.

The more the 99 percent—people without a billion dollars to their name—are indebted, the more hours in the week you have to work and the more dollars you're forced to borrow to make ends meet.

There's only a few this type of creditocracy helps in the end: Big corporations, wealthy CEOs and the ultra-rich.

The Trump administration doesn't have to be harsh to student debtors—40 percent of whom have debt but no degree and are paying on burdensome college debt with the income of a high school diploma.

Student debtors aren't the wealthy, coastal elite—in fact, a chunk of them are Trump voters looking for a financial lifeline.

If Trump winds up cutting student debt relief programs, it will be more evidence that his campaign claim to turn around the economy for the better is akin to his Trump University—fraudulent, trickery, and a lie.

Braxton Brewington is press secretary of Debt Collective.

Elaine Parker: Biden's Loan Forgiveness Programs Are Lawless and Unfair

Team Trump should scrap the Biden administration's student loan forgiveness programs as part of its first 100-day agenda. These programs are lawless and unfair, and they fail to address the root cause of the student loan problem.

Stopping them can also free up funds to advance Trump's broader pro-growth agenda, such as extending and expanding the Tax Cuts and Jobs Act, which is set to expire this year.

President Biden's proposed student loan bailout in 2022 was one of the most flagrant examples of executive overreach in modern American history.

Job Creators Network Foundation sued the administration on behalf of two plaintiffs, and our lawsuit played an integral role in the Supreme Court's June 2023 decision to strike down the program.

Our case blocked the bailout at the district level and stopped the application process, allowing the legal challenge to go to the Supreme Court.

Unfortunately, this victory proved somewhat pyrrhic, as the Biden administration has since lawlessly pursued a series of student loan bailout workarounds in a naked (and ultimately fruitless) vote-buying attempt.

According to the Education Department, Biden forgave $184 billion of student loans for more than five million Americans. "The Supreme Court blocked it," Biden bragged last year, referring to his flagship program, "but that didn't stop me."

Biden's loan forgiveness in all its forms is unfair to Americans who have to pick up the tab for their generally wealthier counterparts.

Ordinary folks don't get their small business loans, credit card debt, or medical bills forgiven. So, why should student debt be treated any differently?

But the bigger issue is that student debt forgiveness ignores the heart of the problem: Unaccountable colleges that overcharge students.

Colleges have raised tuition by more than double the inflation rate over the last generation while sitting on nearly $1 trillion in endowments.

If anyone should be on the hook for student loans, it's colleges themselves. For too long, they have milked students to pay for administrative bloat, programs, and amenities that provide no educational value.

Biden's bailouts give colleges a blank check to continue overcharging and underperforming. They simply kick the can down the road until a new crop of graduates will be clamoring to have their loans forgiven too.

Stopping them can set the stage for long-overdue bipartisan action to hold colleges accountable and stop the wealth transfer from taxpayers and middle-class families.

For instance, colleges should have a direct stake in the outcomes of their students and bear responsibility when graduates can't repay their loans.

Scrapping the programs can also help pay for an extension of the Tax Cuts and Jobs Act, which has been a lifeline for American small businesses during the weak Biden economy. Rep. Jodey Arrington (R-TX) estimates that ending the student loan bailout can save $200 to $330 billion.

By directing these funds to pro-growth initiatives like extending the tax cuts, college graduates can benefit from economic and job opportunities that make their student loans easier to repay.

Ending Biden's student loan bailouts is the right move from a legal, moral, fiscal, economic, and college cost perspective.

Elaine Parker is the president of Job Creators Network Foundation.

All views expressed are the authors' own.

English (US) ·

English (US) ·