Gallagher Re is the first reinsurance broker to publicly provide a provisional industry loss estimate for wildfires impacting the Los Angeles and Southern California region, saying that total aggregated insured losses, largely from the Palisades and Eaton fires, are “expected to notably exceed USD10 billion.”

As we reported on Friday, insurance industry loss estimates for the damaging wildfires have been ranging from $10 billion and upwards, with some analysts suggesting a figure around $20 billion is possible.

As we reported on Friday, insurance industry loss estimates for the damaging wildfires have been ranging from $10 billion and upwards, with some analysts suggesting a figure around $20 billion is possible.

“This total includes expected losses incurred from the private insurance market and from California’s FAIR Plan. Assessments are in their early stages, but the scale of damage suggests this will be one of the costliest series of fires ever recorded for the peril. This guidance is to be considered preliminary and subject to change as the fires remain ongoing,” Gallagher Re explained in a report issued late Friday.

The reinsurance broker added, “Considering historical California fire outbreaks in 2017 and 2018 each led to aggregated insured losses of roughly USD20 billion (in today’s dollars) with a total number of affected structures that potentially could be on par with what might be tallied in 2025, it is not an outlier perspective that the Palisades and Eaton Fires could approach that number.

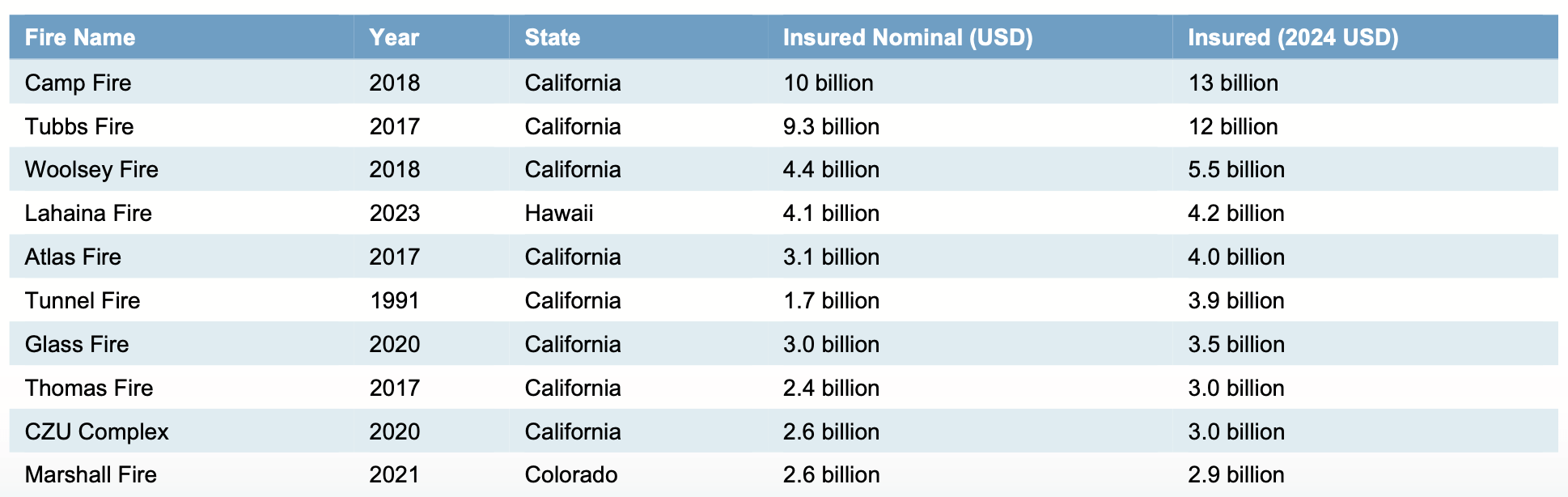

“Both fires are individually expected to rank as one of the top 5 costliest US insured wildfires on record – on a nominal and loss-adjusted (2024 USD) basis. Note that there have now been 24 individual billion-dollar insured loss wildfire events globally since 1990. This is based on nominal values assessed in today’s dollars. All but three have occurred in the US; two in Australia (Black Saturday Bushfires in 2009 and the Black Summer Bushfires in 2019) and one in Canada (Fort McMurray in 2016). The US has recorded 17 individual billion-dollar insured loss fire events since 2015 alone.”

You can see a list of the costliest US wildfire insured loss events in the table below, taken from the Gallagher Re report:

Gallagher Re also explained that the fire losses “are expected to have a significant impact” on California’s FAIR Plan.

“As of the most recent data through September 2024, the Pacific Palisades area carried nearly USD6 billion of exposure; the fifth-largest concentration of FAIR policies in the state,” the broker wrote. “The FAIR Plan has seen a notable uptick in policies as the private insurance market in California has continued to assess its risk and underwriting strategies.”

Steve Bowen, Chief Science Officer and Meteorologist, Gallagher Re commented in relation to the report on the LA and California wildfires, “This is expected to be one of the most expensive wildfire outbreaks ever recorded. The swath of incurred damage, especially with the Palisades Fire and Eaton Fire, suggest an insurance industry impact with a minimum floor loss of $10 billion. The total loss number very well could land notably higher once full damage assessments are completed and it is determined what percentage of properties within the perimeter were actually affected (likely >50%).

“For context, the 2017 and 2018 calendar year fire seasons in California each resulted in roughly $20 billion in insured losses (today’s dollars).

“We’ve now witnessed a multi-billion-dollar fire in Colorado in late December (2021). We’re witnessing multi-billion-dollar fires in California in early January (2025). The wildfire peril has become a calendar year risk. The idea of a traditional ‘fire season’ is no longer accurate as fire conditions are now becoming more amplified outside historically ‘seasonal’ fire months as precipitation patterns become more volatile.

“More people, and therefore exposure (stuff), keeps moving into the Wildland Urban Interface (WUI). Once combined with the climate change influence on fire weather conditions / behavior, it leads to the potential of greater loss.

“The urban conflagration potential in Southern California has long been assessed as a high-risk / low probability scenario. The ferocity of multiple simultaneous urban conflagration events as seen in this current outbreak, however, will ultimately require a new level of risk assessment and seeking to better analyze the plausibility of previously considered “tail events” for this peril moving forward.

“Final note: A very real concern once these fires are extinguished in Southern California will be mudslide / debris flow risk in the months (years) to come. When the inevitable ‘weather whiplash’ occurs and the pattern shifts from dry to wet, there will be a lot of vulnerable communities near burn scar areas. This is another example of compound risk.”

Also read:

– Mercury says LA wildfire losses to exceed reinsurance retention.

– LA fires: “Considerable attachment erosion” likely for some aggregate cat bonds – Steiger, Icosa.

– LA wildfires: Over 10k structures destroyed. Insured losses up to ~$20bn, economic $150bn.

– LA wildfire losses unlikely to significantly affect cat bond market: Twelve Capital.

– LA wildfires unlikely to cause meaningful catastrophe bond impact: Plenum Investments.

– JP Morgan analysts double LA wildfire insurance loss estimate to ~$20bn.

– LA wildfires: Analysts put insured losses in $6bn – $13bn range. Economic loss said $52bn+.

– LA wildfires bring aggregate cat bond attachment erosion into focus: Icosa Investments.

English (US) ·

English (US) ·