Pinterest has published its latest performance update, which shows that the app reached new highs in both active users and revenue in Q4, as it continues on its path towards driving more product discovery.

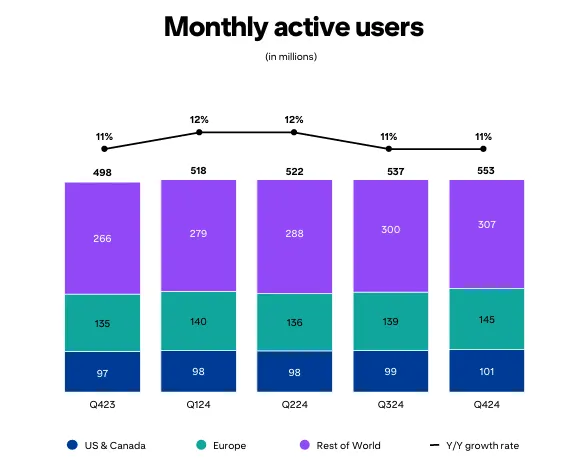

First off, on users. Pinterest reached a new high of 553 million monthly active in Q4, up 16 million on Q3.

That means that Pinterest is gaining growth momentum, with more users coming to the app to search for trending products. Indeed, research shows that the majority of Pin users come to the app with shopping intent, and as its search tools continue to improve, it’s becoming a bigger part of the broader discovery and purchase process.

What’s also worth noting in this chart is that Pinterest gained significantly more users in Europe in Q4, where it had been on track to lose ground versus the beginning of last year. Its growth in the U.S., its main revenue market, is still limited, but it is gaining in all markets, based on this latest update.

That suggests that Pinterest is on the right track with its tools, though it could also be a holiday shopping bump, so it may slide again in Q1. But it is worth noting that Pinterest is holding, and gaining, in its main income segments.

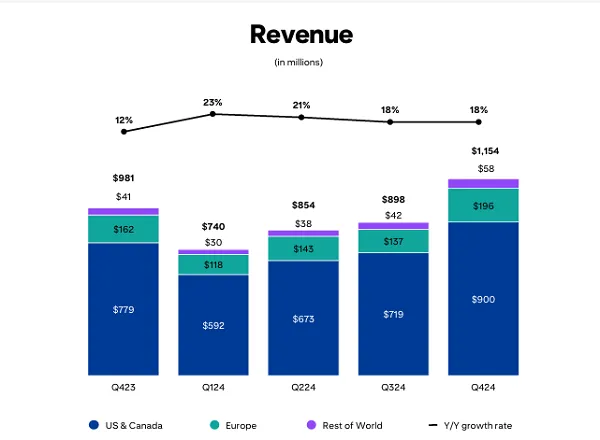

On the revenue side, Pinterest brought in a record $1.2 billion million, taking its yearly revenue intake to $3.6 billion.

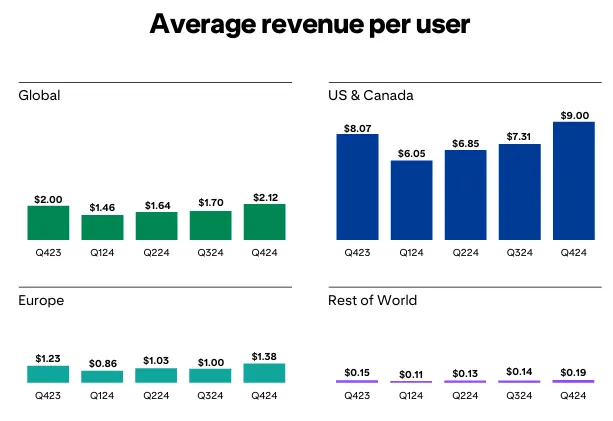

For the full year, Pinterest was up 19%, which is an impressive growth rate, and it seemingly still has a lot of room for improvement when you look at its revenue per user stats:

Pinterest’s income numbers outside the U.S. are not great, though that also suggests that it can make up more ground here, and with its usage growing, that should present more opportunities in the near future.

It still has some work to do on reaching advertisers in these markets, and winning them over with Pin campaigns. But maybe, this is the year that it can boost those numbers closer to its U.S. intake.

Though that’ll also require investment, and Pinterest has seemingly worked to keep its sales and marketing spend steady, rising just 10% year-over-year. Its research and development expenses rose by double that, and it might be challenging for Pinterest to maximize its opportunities without a period of significantly increased spending.

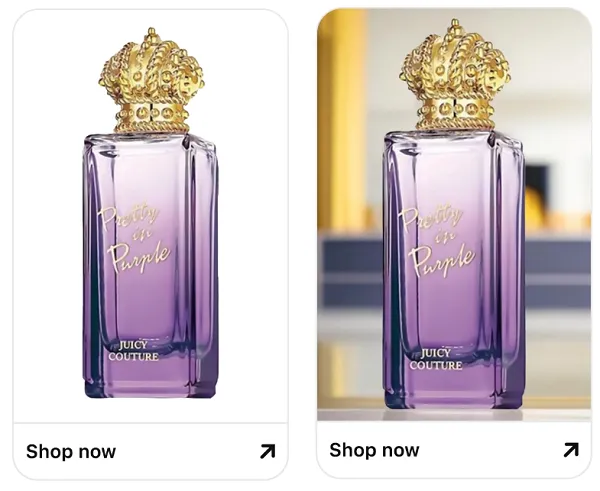

But even at more subdued spending rates, Pinterest continues to develop impressive tools, like its AI-powered Performance+ ads, and its evolving discovery tools to improve the accuracy and relevance of its search results.

Pinterest has also added functional elements, like its remixing and sharing options for collages, though it hasn’t gone the typical social platform route of adding in AI chatbots and image generators to boost engagement.

Yet.

At this stage, Pinterest has remained focused on updates that align with its core use case, as opposed to trying to be everything to everyone, and occupy more scroll time. But I expect that Pinterest will incorporate more AI elements in future, likely in the form of generative AI outfits, enabling you to create an image of what you like, then searching the app for similar product matches.

Overall, the trends here are good for Pinterest, with third-party reports also showing an increase in audience interest, aligning with its own figures. It still needs to improve its ad business outside of the U.S., and it’ll likely need to spend money to boost both this and its broader innovation efforts.

But record highs in both active users and quarterly revenue are solid indicators.

)

)

English (US) ·

English (US) ·