Choosing not to pay back student loans could lead to a series of unfavorable financial consequences. Many of these negative affects could snowball and make your overall financial future uncertain.

Why It Matters

Student loan payments resumed in October 2023 after government-mandated forbearance in response to the COVID-19 pandemic ended. Lasting inflation is creating a greater strain on Americans' wallets, and some people are delaying paying their student loans to cover other expenses.

However, student loan delinquencies and defaults are going to be reported to the credit bureaus, and subsequently, to potential lenders. Getting the negative marks off a credit report can take years, making certain aspects of getting ahead financially more difficult.

What To Know

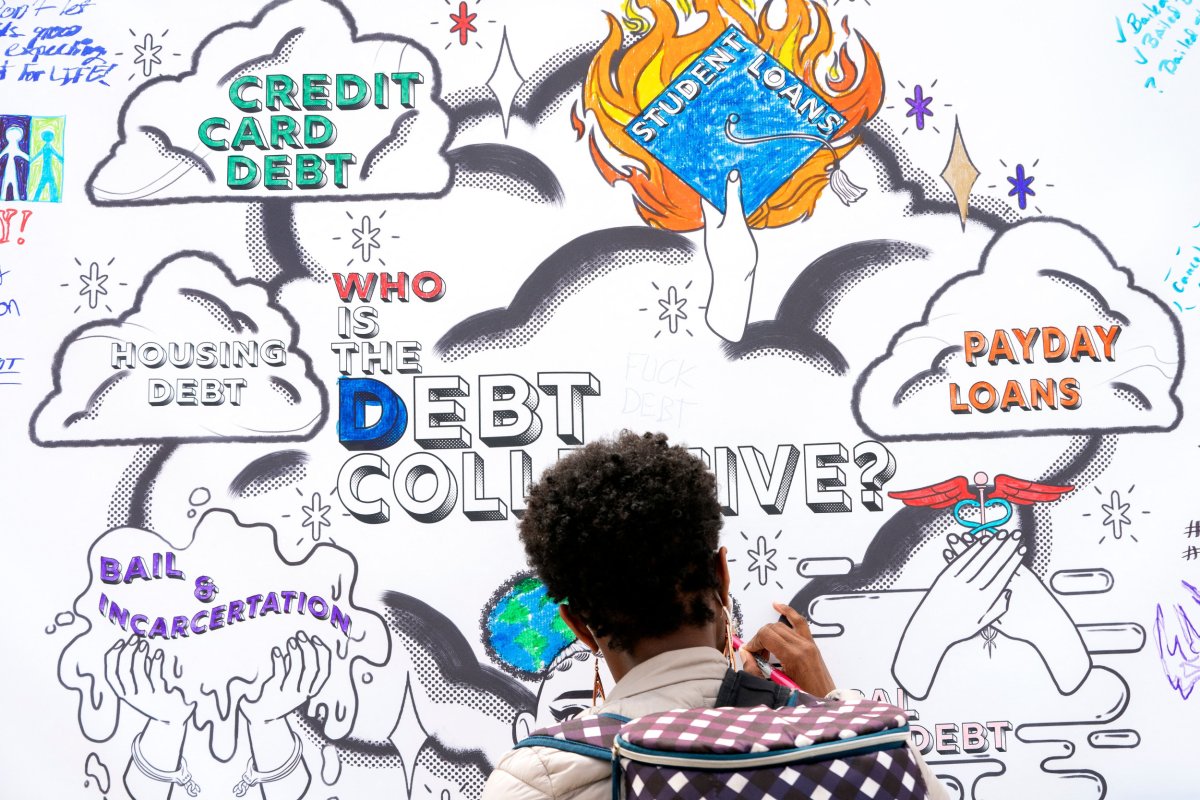

Affordability is a major consideration for many when weighing whether or not to pay federal student loans. Others elect to voluntarily skip student loan payments as "an act of civil disobedience." Defaulting on student loan payments can lead to many damaging affects on your finances overall, and borrowers will have to weigh of some of these consequences are worth it.

Some of what could happen to borrowers depends on the type of student loan. Federal student loan holders who default can have tax refunds withheld, wage garnishments and even have limits placed on their Social Security benefits. Private lenders may send loan balances to collections agencies or even file a lawsuit.

Defaulting on a student loan account is not always something that happens immediately. According to Federal Student Aid, the first time you miss a payment is when your account becomes delinquent, though some loan types may immediately put an account in default after the first missed payment.

If your account becomes delinquent, it will remain so until you make any necessary changes to bring the account current, often in the form of paying the past due amount or enrolling in a payment plan.

When Are Student Loans Put Into Default?

For an account to reach default, you must be past due on payments for 90 days or more, after which your loan servicer will report this activity to the credit bureaus and negative marks will start to show on your credit report.

Other outcomes related to default include:

- An entire unpaid balance becomes due immediately, including interest

- Lost eligibility for deferment or forbearance

- Lost eligibility for more federal student aid

- Litigation

Negative marks on your credit report can make it more difficult to acquire more types of credit in the future, like a credit card, personal loan or mortgage. If you're able to access these types of credit after defaulting on a student loan, you'll likely face high interest rates.

What People Are Saying

Michael Lux, an attorney and founder of Student Loan Sherpa, told Newsweek: "The really sad part about this process is that in many cases borrowers pay more in the form of wage garnishments than what they would have had to pay if they were on an income-driven repayment plan."

Kate Wood, lead writer, spokesperson and student loan expert for Nerdwallet, told Newsweek: "At the moment, a decent-sized chunk of borrowers aren't making payments because they're in an administrative forbearance while the SAVE plan is on hold. That means they don't have payments due, but borrowers are potentially kicking that debt down the road. Even if the SAVE plan won its legal battles, time spent in this administrative forbearance doesn't count toward student loan forgiveness."

What Happens Next

If you can't afford your student loan payment, the Consumer Financial Protection Bureau (CFPB) recommends contacting your loan servicer to explore your repayment options. Your choices may differ depending on whether you have federal or private student loans.

English (US) ·

English (US) ·