According to Thad Hall, Partner and Head of insurance-linked securities (ILS) Solutions at Augment Risk, the risk capital and reinsurance solutions broking firm, the ongoing growth trend with alternative capital is expected to continue throughout 2025, given the high returns for ILS relative to other assets.

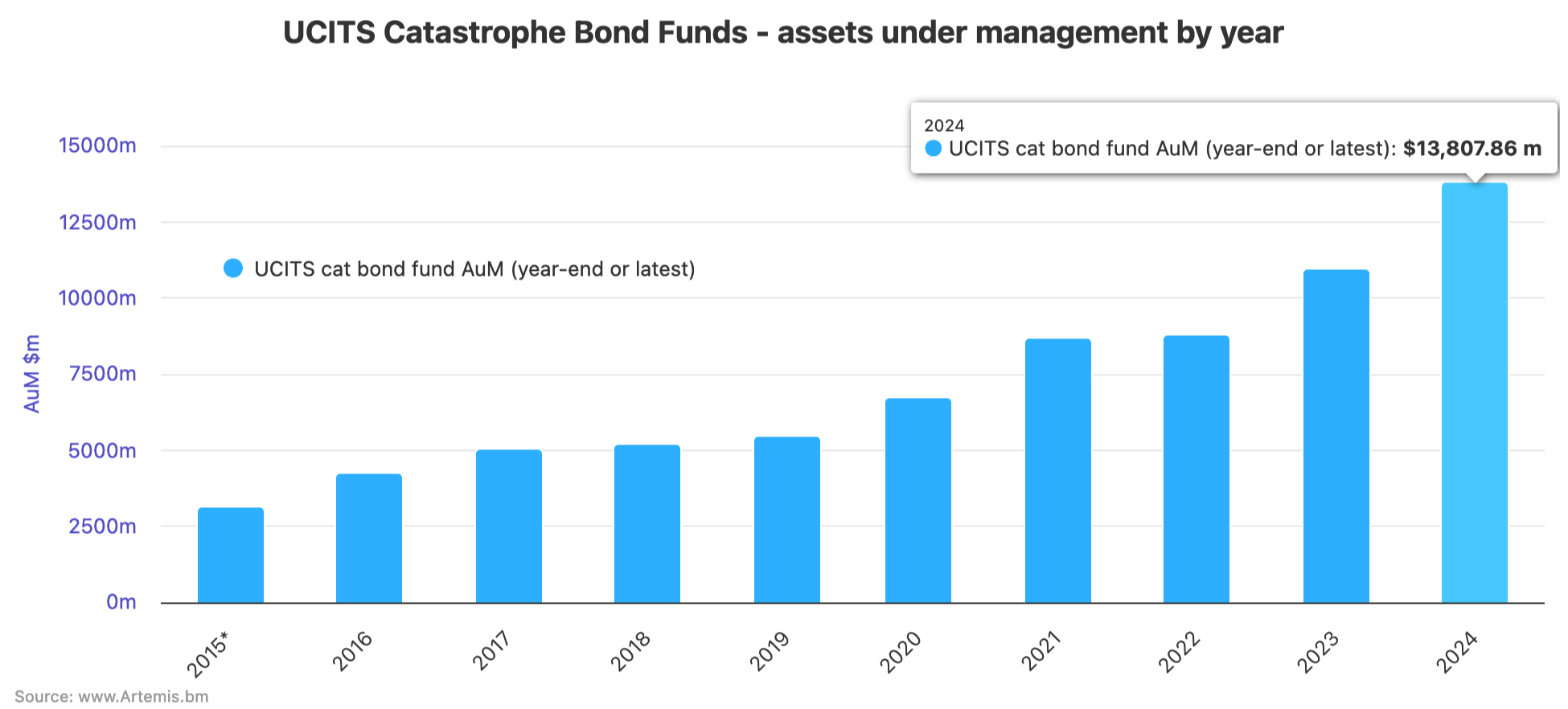

Global credit ratings agency AM Best revealed that alternative capital expanded by 7% in 2024, reaching a remarkable US$107 billion in 2024.

Global credit ratings agency AM Best revealed that alternative capital expanded by 7% in 2024, reaching a remarkable US$107 billion in 2024.

“In the past two years the Swiss Re Cat Bond Index has risen 19.7% and 17.3%. This level is comparable to public equities and ILS investors get the added benefit of a low correlation to other assets,” Hall said.

Hall also told us what he is hoping to see take place across the ILS market in 2025.

“More ILS funds expanding their products to include casualty risk. Also private credit investors entering the ILS market. ILS is a form of risk financing; private credit can add an asset with low correlation to loans and achieve attractive returns,” he commented.

Looking back at 2024, it was a memorable year for the catastrophe bond and ILS market. In the fourth quarter of the year, $4.5 billion of cat bond and related ILS market issuance was recorded, which managed to take the full-year 2024 total to a record $17.7 billion, while the outstanding market reached a new all-time-high of $49.5 billion.

Hall explained what the industry learned in 2024 in regards to cat bonds insurance and capital management.

“Capital solutions are favoured by clients and investors. A holistic approach to managing capital for insurers and reinsurers through structured reinsurance and ILS can create material economic value over time,” he commented.

A key topic that is often discussed across the insurance and reinsurance space is artificial intelligence (AI), with many organisations expanding their use of the technology.

However, AI, which is more of an underdeveloped area across the ILS space, is expected to receive more attention in 2025, according to Hall.

“We are exploring ways to expand the use of AI in the ILS process. Augment Risk has a data and analytics team who assists the ILS deal team with loss and risk-based capital modeling. There is a collaboration between these teams and Augment Risk’s CTO to develop greater AI capabilities.”

Switching attention now towards the investment side, we asked Hall to explain what he believes investors will be focusing on throughout 2025.

He explained that Augment Risk is focusing on a note structure to finance stable portfolios of casualty risk, in which the notes will have a fixed maturity and may be supported by an equity layer.

“We are working with several investors who can transact in note format. We would like to see this structure gain more traction as an option to bring capital to transforming vehicles,” he added.

English (US) ·

English (US) ·