The question of potential recoveries from subrogation of claims has emerged in relation to the ongoing wildfires in Los Angeles and Southern California, with electrical utility Southern California Edison in focus as questions arise over whether its equipment may have caused any of the fires.

Electrical utilities in California have faced significant claims in previous major wildfire outbreaks, as property insurers recovered amounts after equipment was deemed to have sparked some blazes.

Electrical utilities in California have faced significant claims in previous major wildfire outbreaks, as property insurers recovered amounts after equipment was deemed to have sparked some blazes.

These subrogated amounts flowed back to the benefit of certain insurance firms, reducing their ultimate net losses from the events and in certain cases resulting in recoveries being made by reinsurance capital providers.

In one case, subrogation recoveries have even flowed back to the benefit of catastrophe bond funds and investors, driving a return of principal with respect to previously made loss payments under certain reinsurance agreements within some of USAA’s cat bonds that had been affected by wildfires.

With the California wildfires still burning in the Los Angeles region, it has been reported that some insurers have filed notices to preserve evidence related to the Eaton fire with electrical utility Southern California Edison.

The Eaton fire remains only 33% contained and is reported to have damaged or destroyed upwards of 7,000 structures.

The utility said, “SCE received evidence preservation notices from counsel representing insurance companies in connection with the fire.

But added, “To date, no fire agency has suggested that SCE’s electric facilities were involved in the ignition or requested the removal and retention of any SCE equipment.

“Additionally, preliminary analysis by SCE of electrical circuit information for the energized transmission lines going through the area for 12 hours prior to the reported start time of the fire shows no interruptions or electrical or operational anomalies until more than one hour after the reported start time of the fire. Aside from the preservation notices suggesting SCE’s potential involvement and significant media attention surrounding the fire, we do not believe this incident meets the reporting requirements.”

So, at this stage it seems there is no official investigation related to the Eaton fire, however legal action has ensued.

The BBC reported that law firm Bridgford, Gleason & Artinian filed a complaint, stating it believes the Eaton Fire was ignited because of SoCal Edison’s “failure to de-energize its overhead wires which traverse Eaton Canyon – despite a red flag PDS wind warning issued by the national weather service the day before the ignition of the fire.”

A second legal complaint has also been filed, according to some media reports.

Meanwhile, the Hurst fire, which is far more contained currently at 95% and has less damage attributed to it at this stage, sees Southern California Edison equipment being investigated.

Southern California Edison said, “Preliminary information reflects the Eagle Rock – Sylmar 220 kV circuit experienced a relay at 10:11 p.m. A downed conductor was discovered at a tower associated with the Eagle Rock – Sylmar 220 kV circuit, but SCE does not know whether the damage observed occurred before or after the start of the fire. SCE understands that fire agencies are investigating whether SCE equipment was involved in the ignition of the Hurst Fire. The investigation is ongoing.”

It remains unknown whether any liability may be directed at the utility for this wildfire, due to its equipment, but it raises the subject of subrogation, which a number of equity analysts have also commented on.

Analysts at Goldman Sachs said, “It remains too early to tell if the fire was caused by a utility. According to various sources, insurers have provided Southern California Edison with notices to preserve evidence related to the Eaton Fire. Insurers have made material recoveries through subrogation following previous fires, including the Thomas Fire and the Woolsey Fire in Southern CA.”

Previously, Southern California Edison had itself faced a $1.16 billion payout for claims related to the 2017 Thomas and Koenigstein fires and 2018 Montecito Mudslides.

This utility had also agreed a $2.2 billion payout to settle all insurance subrogation claims from litigation related to the 2018 Woolsey Fire and exhausted its wildfire coverage as a result.

Pacific Gas and Electricity (PG&E), perhaps the most wildfire cost impacted Californian electrical utility, had made $11 billion of subrogation payments in relation to the 2017 and 2018 California wildfires, while it saw additional subrogation claims for 2015 and 2016 wildfires as well.

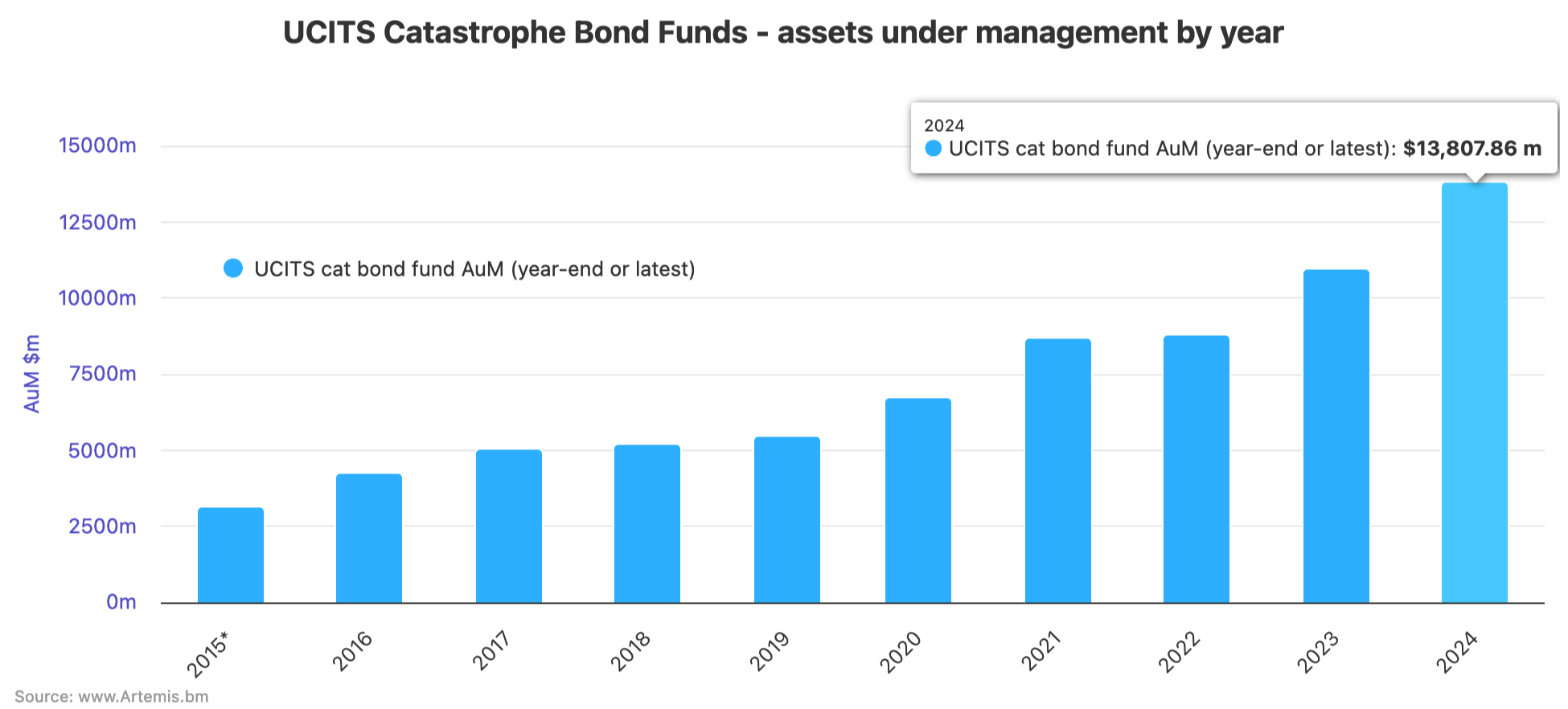

In their latest report, Goldman Sachs analysts highlighted some of the larger wildfire subrogation claims that have been settled, see image below:

With Southern California Edison’s equipment facing a fire authority investigation related to the Hurst fire, it does raise this topic again, which will be watched closely by insurance and reinsurance market interests.

However, with the Hurst fire much less damaging than the Eaton and Palisades blazes, subrogation would not be a significant driver of recoveries, it seems, as the insured losses from that fire appear set to be far lower.

Analysts at BMO Capital Markets highlighted another subrogation related thread, as the WSJ had reported the Los Angeles Department of Water & Power (LADWP) did not have a plan to de-energise its power lines when these recent wildfires occurred.

While there hasn’t been any specific news regarding any LADWP investigation, the analysts said, “If LADWP’s equipment was involved in the cause of the fire, Inverse Condemnation and the strict liability standard making it liable for any damages independent of fault (i.e. negligence) would apply and the insurers would be able to pursue subrogation claims like in 2017/2018 for PG&E.

“The WSJ highlighted that Los Angeles Department of Water & Power (LADWP) did not de-energize its lines since it does not have the capabilities to do Public Safety Power Shutoffs (PSPS), but having live wires during those dangerous wind conditions certainly means it could be possible for loose equipment to detach and spark a fire, but the article stopped short of formally pointing the finger at it or identifying a cause.”

Recall that the LADWP has previously sponsored two catastrophe bonds, to bolster its wildfire risk capital resources, but both of these have already matured.

With the wildfires still burning, there is great uncertainty over the ignition sources that started them and while investigations are ongoing the fires still burn, so it will be some time until clarity emerges over any utility liability for any of the fires.

The way subrogation claims are paid for by California’s utilities has changed as well, since the establishment of the Wildfire Fund, in which Southern California Edison is a participant, alongside San Diego Gas & Electric Company and Pacific Gas & Electric Company (PG&E).

This fund has been designed to provide claims-paying protection for the three utilities and had a targeted total capacity of $21 billion when launched.

As of as of December 2024, the Fund had received over $14,74 million in capitalisation, financial statements show.

It acts as a risk pool for the utilities, with a trigger mechanism that means one must be deemed responsible by the California Department of Fire and Forestry Protection for causing a wildfire and claims must exceed $1 billion in a calendar year.

It would help cover subrogation claims made against utilities by insurers, providing ready capital resources should the fund triggers be met.

The FT reported, “If Edison’s equipment caused the fires in Southern California, the fund will probably absorb some of the utility’s costs (depending on what fires the state determines is “covered”). And if Edison was found to be negligent, it will be required to reimburse some of those fund costs, up to 20 per cent of its equity rate base.

“Edison’s maximum reimbursement would be around $3.9bn, according to CreditSights analysts Andy DeVries and Nick Moglia.”

The Wildfire Fund was established in 2019, after the significant and costly California wildfire years. So as a risk capital resource it has not been tested at this stage.

Recall that this Wildfire Fund, which is administered by the California Earthquake Authority (CEA), is allowed to buy reinsurance or risk transfer in other forms to protect its resources, but only did so the once in its history that we are aware of.

Subrogation will likely remain a topic of discussion while the California wildfires continue to burn and until investigations can identify the sources of ignition for each fire.

As we’ve explained, subrogation settlements have previously seen utilities returning substantial amounts of capital to insurers after they were deemed liable for equipment causing massive wildfires that drove billions of dollars of losses across the insurance and reinsurance sector.

Should any liability be assigned to any utilities for the ongoing fire events, it can take months or years for subrogation payments to be agreed and any recoveries to be made by insurance or reinsurance capital providers.

Also read:

– ICEYE satellite analysis: Over 10,900 buildings likely destroyed in Palisades and Eaton fires.

– Catastrophe bond price movements due to LA wildfire exposure.

– LA wildfire losses to “notably exceed” $10bn, could approach $20bn: Gallagher Re.

– Mercury says LA wildfire losses to exceed reinsurance retention.

– LA fires: “Considerable attachment erosion” likely for some aggregate cat bonds – Steiger, Icosa.

– LA wildfires: Over 10k structures destroyed. Insured losses up to ~$20bn, economic $150bn.

– LA wildfire losses unlikely to significantly affect cat bond market: Twelve Capital.

– LA wildfires unlikely to cause meaningful catastrophe bond impact: Plenum Investments.

– JP Morgan analysts double LA wildfire insurance loss estimate to ~$20bn.

– LA wildfires: Analysts put insured losses in $6bn – $13bn range. Economic loss said $52bn+.

– LA wildfires bring aggregate cat bond attachment erosion into focus: Icosa Investments.

English (US) ·

English (US) ·