The team behind the failed meme coin $HAWK token, fronted by Hailey Welch who is better known as the viral 'hawk-tuah girl', has addressed backlash after the cryptocurrency completely bombed.

$HAWK token was publicised heavily and quickly rose to a $490 million market cap when launched on 4 December but it absolutely tanked within hours and lost around 95 per cent of its value.

It cost millions collectively to people who had bought the cryptocurrency.

It's understood $HAWK token was the victim of a 'rug pull', where snipers who buy the asset where it's cheaper and instantly sell it where it's more expensive end up making a huge profit, according to CoinMarketCap.

A lawsuit has been filed accusing overHere, its founder Clinton So, social media influencer Alex Larson Schultz and the Tuah The Moon Foundation (which is understood to have overseen the finances of the meme coin) of unlawfully promoting and selling cryptocurrency that was allegedly never properly registered.

Now, overHere, the platform for $HAWK token, has explained its side of what happened on social media.

A X / Twitter post said: "We saw $HAWK as the perfect use case for our startup's idea: to bring airdrops to Web2. Haliey Welch - a literal meme - launching a meme coin felt like synchronicity.

"Our goal was simple: bring Web2 fans into Web3 seamlessly. A way to bring Web2 into crypto through culture, not just speculation. First of its kind. That's it. For free.

"We believed in that vision so much that pushed harder and harder, perhaps through rose-tinted glasses and naivety about others' intentions, even as the project began to unravel."

overHere went on to say someone who is known as Doc Hollywood "controlled all decisions, fees, treasury" and he charged "15 per cent trading fees (none to overHere), [was] silent during market chaos and ignored calls for transparency".

"As desperation kicked in, participation conditions were progressively watered down," the team said. "What started with plans for a lock-up eventually ended with none."

It wants "Haliey's team to step up, Doc to step down and a full treasury audit" after claiming it made no revenue at all.

International Business Times (IBT) reports Schultz, a team member nicknamed Doc Hollywood, has denied these allegations.

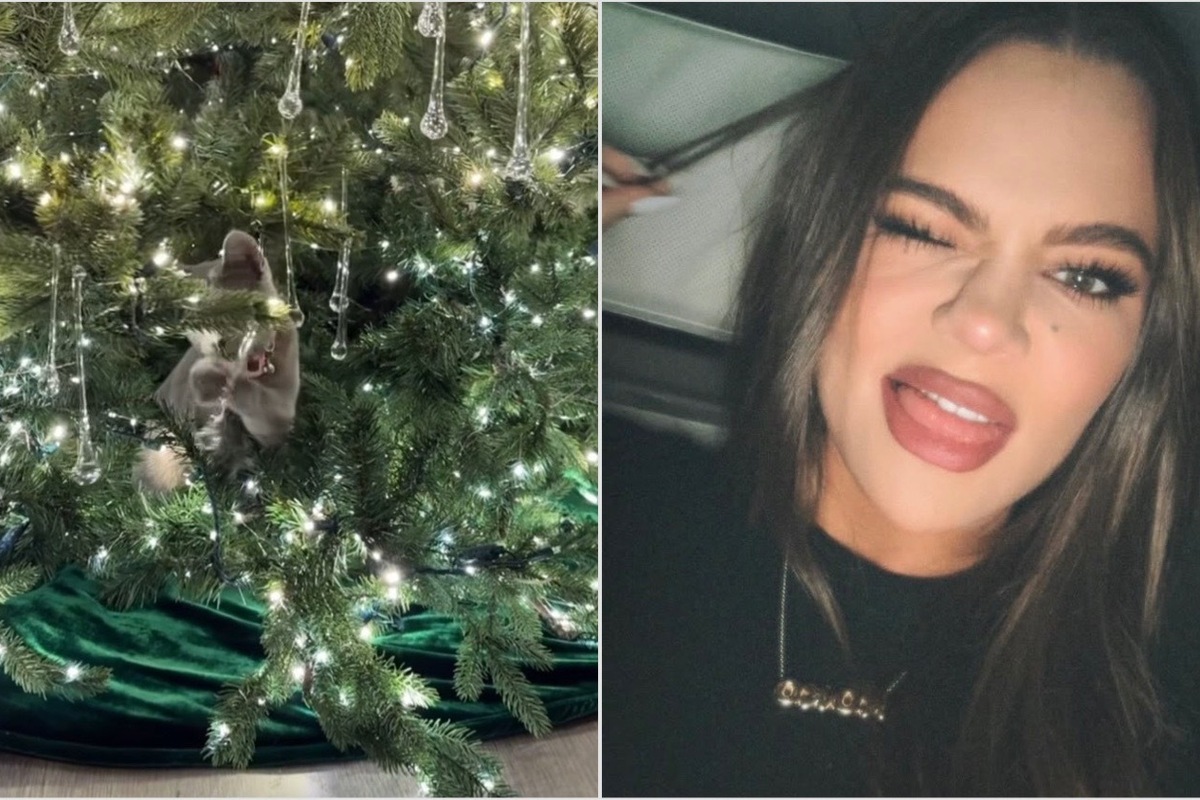

Welch herself has also hit back at the backlash.

She posted on X / Twitter: "Copy and pasting: Hawkanomics: Team hasn't sold one token and not one KOL was given one free token. We tried to stop snipers as best we could through high fees in the start of launch on @MeteoraAG. Fees have now been dropped."

According to IBT, Welch's lawyer Christian Barker said she was paid £98,135 ($125,000) to promote the coin alongside a 50 per cent share of the net proceeds after expenses.

Welch has claimed ignorance of crypto regulations.

A number of people who lost out financially have filed complained with the US Securities and Exchange Commission (SEC).

How to join the indy100's free WhatsApp channel

Sign up to our free indy100 weekly newsletter

Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

5 hours ago

3

5 hours ago

3

English (US) ·

English (US) ·