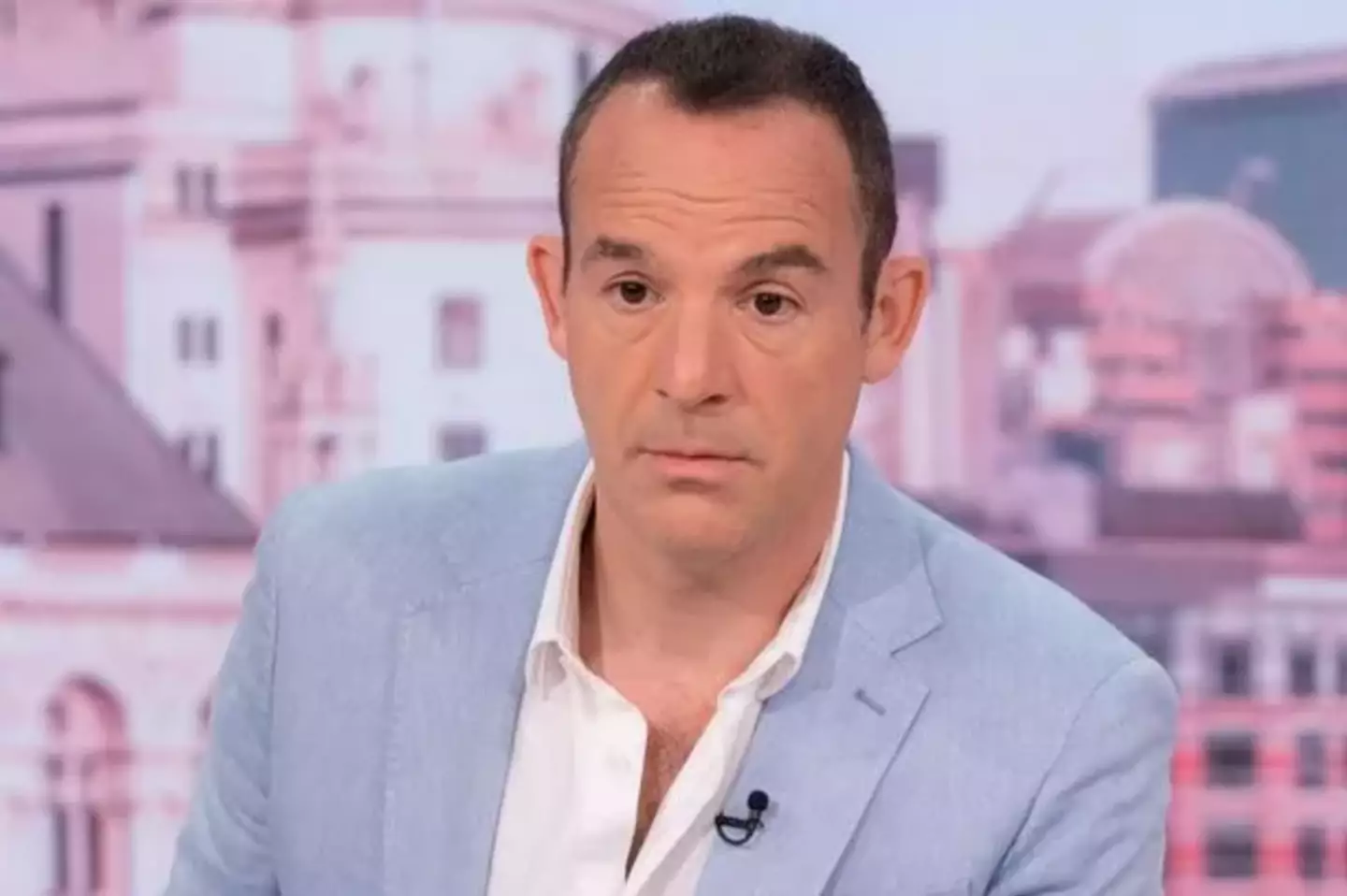

Martin Lewis has issued a 'huge' update to those who bought a car before 2021 and it concerns putting money back in your pocket.

The Money Saving Expert founder made the announcement on social media following a recent decision taken this morning by the Financial Conduct Authority (FCA).

With millions of finance deals that were taken out between 2007 and 2021 for the likes of cars, vans, motorbikes, and even camper vans, it concerns what we weren't told by dealerships when signing up to the agreement. In particular, it is to do with the interest rates on agreements, with them being increased and not flagged to the buyer.

The FCA took a stand against this back in 2021, banning the practice known as discretionary commission agreements (DCAs). Roughly 40 percent of finance deals in the 14 year time period used DCAs, with billions now expected to be owed to Brits in compensation as the investigation continues.

Currently, a ruling is expected to be made some time in the spring of next year. But in a 'huge' update from the FCA and Lewis, the goalposts have shifted significantly with the window for complaints widened.

"Now, most people who’ve had any type of car finance are being urged to complain – doubling the numbers," Lewis said over on X (formerly Twitter).

"The FCA announced it is consulting for two weeks (so quick, it's a likely done deal) on extending the time firms have to handle motor finance commission complaints. This is on the back of a Court of Appeal ruling a couple of weeks ago and the extension is to incorporate a potential Supreme Court decision.

"The key bit - while not specified in its announcement, I've had it confirmed this applies to ALL car finance commission complaints, not just the Discretionary Commission Arrangements (DCAs) complaints previously covered."

Martin Lewis has labelled the car finance update as 'huge' (ITV)

What does this mean? Even if you don't think you had a DCA, the FCA has now widened the complaints window, 'paving the ground to in future broaden the scope of its car finance investigation', Lewis explains.

"So not only at the 40 percent of past claims that had DCAs (where dealers could increase their commission by increasing interest) but all commissions including fixed commissions," he says.

"This is on the back of the Court of Appeal ruled 'consumers need to know all material facts including the amount of commission' which they often weren't told even in fixed commission cases.

"It looks like (I need to dig) if the hold is extended, almost everyone who has had car finance deals may have a complaint (I need to examine timelines of what counts) and be potentially due money back (this includes those already rejected as they were told they 'didn't have a DCA'). This potentially more than doubles the number of people involved, and would really start to look more like PPI scale of payouts (and a substantial threat to the car finance industry)."

DCA claims are valid for cars bought on finance between 2007 and 2021 (Getty Stock Images)

The next thing do to is log your complaint sooner to avoid missing out on a potential time cap

On what it means for those with DCA complaints, Lewis says: "I think this makes it more likely that DCA commission cases will get future payouts. For 'fixed' commissions, this isn’t about the FCA, it all strongly swings on if the Supreme Court upholds the Court of Appeal ruling (assuming it accepts the appeal to it, which the FCA has urged it to do, and to do at speed). That’s the key to if the FCA will broaden its scope.

"These are provisional first thoughts, bashed out at speed, obviously there's more work to do, but it is big."

The scheme is being expanded, Lewis has been told (Getty Stock Images)

Can I make a claim?

You can submit a car finance claim over a potential DCA if you meet the following criteria:

- The vehicle you took finance out for was a car, van, motorbike or camper van

- The finance deal was taken out between April 2007 and 28 January, 2021

- The vehicle was for personal use (including commuting to work)

- The finance was either personal contract purchase (PCP) or hire purchase (HP) - but importantly, it cannot have been personal contract hires

You can claim on behalf of someone who has died if you are the executor of their will or the beneficiary. You also don't have to still own the car to make a claim

English (US) ·

English (US) ·