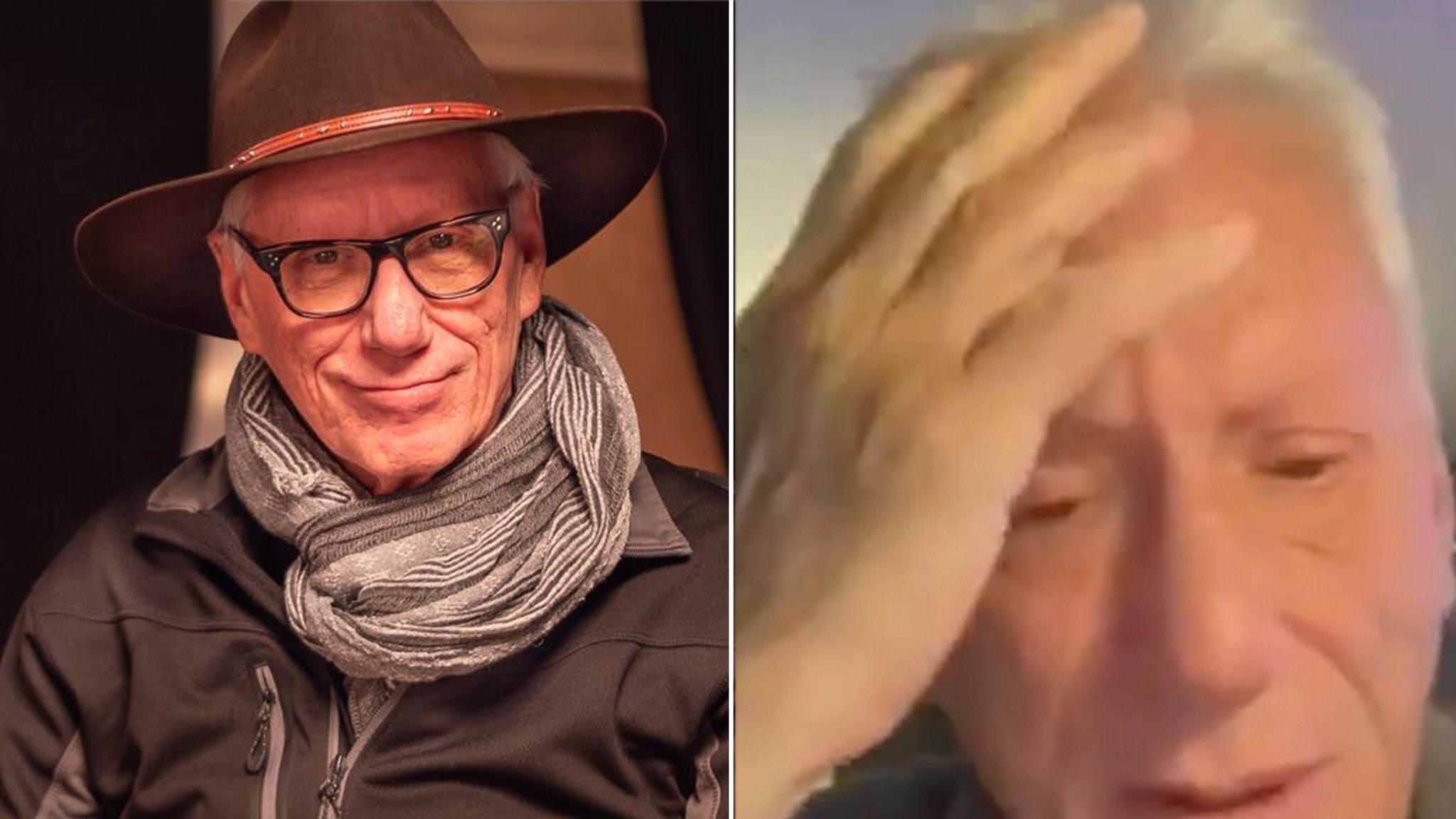

Uh-oh!!! Sunny Hostin‘s husband has been named in a MASSIVE federal insurance fraud lawsuit!

According to DailyMail.com on Tuesday, The View co-host’s husband, orthopedic surgeon Dr. Emmanuel ‘Manny’ Hostin, is one of nearly 200 defendants listed in what is now one of the largest RICO cases EVER filed in New York. In it, he is accused of getting “kickbacks” by performing surgery and fraudulently billing a company that insures taxi companies as well as Uber and Lyft drivers. The lawsuit was filed on December 17 in Brooklyn.

Related: Jimmy Kimmel Gives Selena Gomez A SUPER Creepy Engagement Gift!

Per the claims, various doctors allegedly billed the insurance firm American Transit “in exchange for kickbacks and/or other compensation which were disguised as dividends or other cash distributions.” In the suit, Dr. Hostin is named as the owner of Hostin Orthopaedics. The insurance company is claiming that the doc was given an “investment” interest in Empire State Ambulatory Surgery Center in exchange for referring a “steady stream” of patients. The docs noted:

“Empire State ASC issued regular payments to or for the benefit of Hostin, which, in fact, were illegal kickbacks for referrals.”

For example, the company claimed Hostin saw two patients in January 2023 who were involved in “low-impact” collisions. The insurance company argued these incidents should have resulted in “no more than soft-tissue injuries,” but that the doctor took a more serious, more costly, and allegedly unnecessary approach to solving the issue by performing arthroscopic surgery within two months — without checking to see if the patients would recover from more conservative care first.

More generally, American Transit condemned the “rampant” insurance fraud in the state, blaming it on New York’s “No-Fault Law,” which requires insurers to pay up to $50,000 for medical expenses for people injured in road accidents. The company said in a statement:

“These substantial possible no-fault recoveries can incentivize providers with ill intent to over-diagnose, over-treat, and over-bill to recover the most money for themselves.”

American Transit noted the law was introduced in 1974 “in the wake of rapidly rising automobile insurance costs and when accident victims were experiencing long delays in compensation.” Taxis and ride-share cars are reportedly now required to pay up to $200,000, four times the amount of coverage required for private drivers. The lawsuit continued:

“This has put a target on the backs of livery vehicles, and the insurance companies which insure them, for unsavory person seeking to capitalize on payouts following injuries. […] In the aggregate, those abusing the No-Fault Law have racked up hundreds of millions in fraudulent payments, destabilized the livery insurance market in New York City, increased premiums for hard working taxi-can [sic] and livery drivers, and harmed the public.”

They are seeking $450 million in damages. Whoa!

Hitting back at the lawsuit, the doc’s attorney Daniel Thwaites told DM that his client “denies each and every allegation,” calling the filing a “blanket, scattershot, meritless lawsuit by a near-bankrupt insurance carrier.” The lawyer continued:

“It is meant to intimidate and harass doctors from collecting for care given to American Transit insureds and their passengers.”

He praised his client for having an “impeccable” record while arguing that the insurance company didn’t even do their due diligence before filing:

“American Transit has rushed into the lawsuit without ever conducting an examination of Dr. Hostin or expressing any concerns to his lawyers. The real story here is about an insurance carrier abusing the legal system to limit and restrict health care benefits to its insureds and their passengers, and write off its proper obligations.”

Meanwhile, William Natbony, an attorney for American Transit, told the outlet:

“No fault fraud is a huge problem in New York. American Transit filed a lawsuit as part of its statutory responsibility to fight such fraud.”

However, Steven Harfenist, a lawyer who has represented defendants in similar cases, told Law.com that this lawsuit “looks like a hail Mary” by the insurance company. He straight up called it a desperate attempt at “wiping out large swaths of receivables” by targeting smaller practices that may not be able to afford litigation and could therefore be forced to settle.

Seems messy!! So far, Sunny hasn’t commented on this Hot Topic. Reactions?! Share ’em (below).

[Image via Sunny Hostin/Instagram & ABC/YouTube]

English (US) ·

English (US) ·