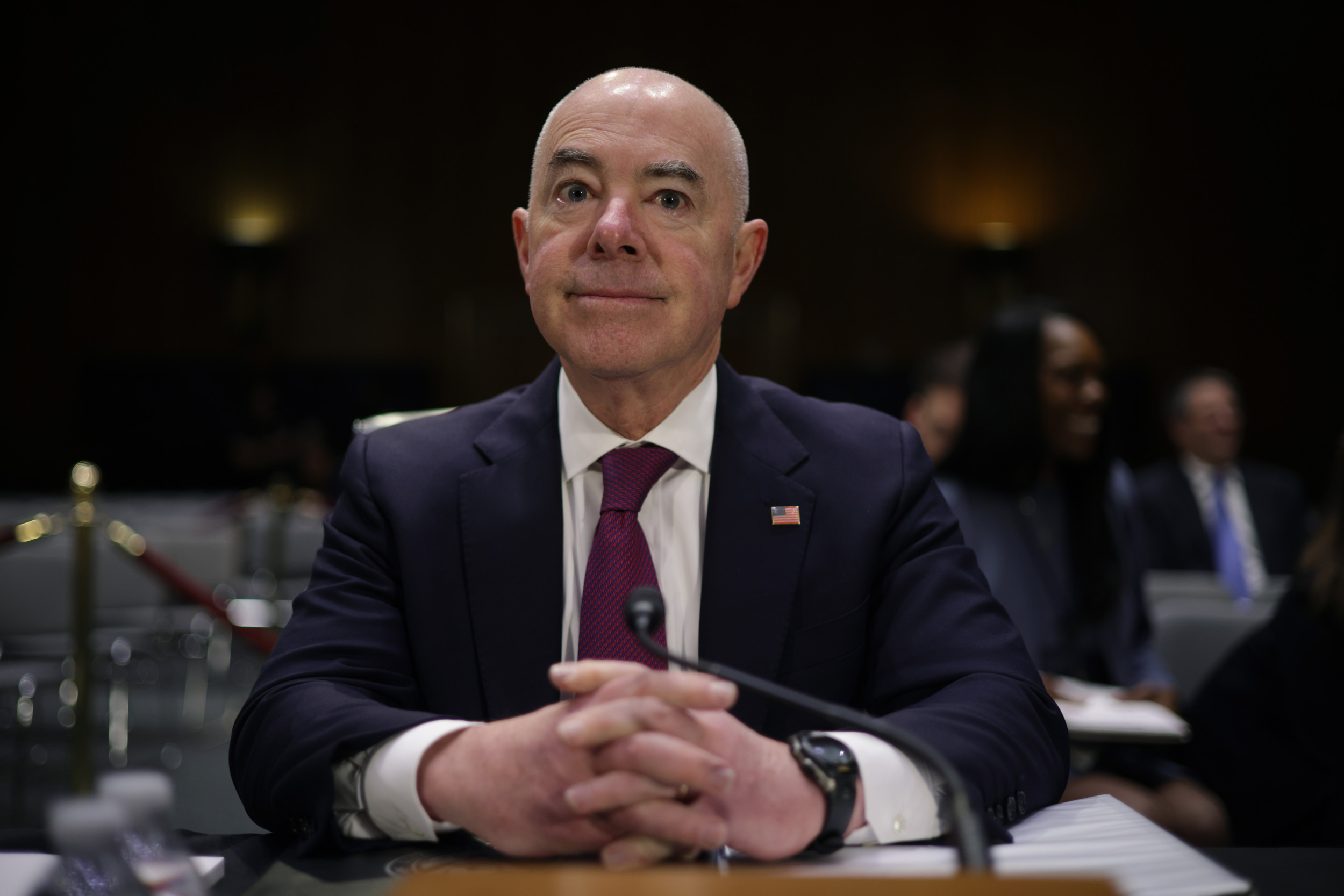

Shares in India's Adani Group took a significant hit on Thursday, dropping by as much as 20 percent, following the unsealing of a U.S. indictment against its founder, Gautam Adani.

The charges accuse the 62-year-old tycoon of duping investors through a massive solar energy project in India, which allegedly involved bribery schemes.

The indictment was filed by federal prosecutors in New York, who charged Adani with securities fraud and conspiracy to commit securities and wire fraud.

Adani Group Scraps US Bond Offering in Wake of Legal Action

The legal troubles surrounding Adani have already had financial consequences. In response to the U.S. indictments, the Adani Group canceled a planned U.S. dollar-denominated bond offering.

This move was announced by Adani Renewables in communications to both the BSE (formerly known as the Bombay Stock Exchange) and the National Stock Exchange of India.

The Adani Group, however, firmly denied the allegations, describing the charges against its directors as "baseless."

"We want to emphasize that these are allegations, and the defendants are presumed innocent unless proven guilty," the U.S. Department of Justice noted.

Newsweek has reached out to the Adani Group for comment via email.

Gautam Adani's Rise to Prominence

Gautam Adani's journey from a middle-class background to one of Asia's wealthiest individuals has been marked by his rapid expansion into various sectors.

Starting as a diamond trader, he founded Adani Enterprises in the 1980s, which eventually evolved into India's second-largest conglomerate.

Over the years, Adani's projects have spanned multiple industries, from coal mining and energy to infrastructure and defense. Notably, his energy company Adani Green aims to become the world's largest renewable player by 2030.

Adani's rise in the 1990s coincided with India's economic liberalization, which opened new opportunities in sectors including infrastructure, coal, and renewable energy.

His company's portfolio includes major airports, roads, and ports, with Adani Ports operating India's largest private port.

Adani Faces Political and Legal Scrutiny

Despite his business success, Gautam Adani's rise has been mired in controversy. He is widely seen as being closely aligned with the government of Prime Minister Narendra Modi, both hailing from the western state of Gujarat.

Adani's critics argue that his success is largely due to these political ties, accusing the government of manipulating contracts to favor his companies.

Opposition leader Rahul Gandhi has demanded Adani's arrest in both India and the U.S., and a parliamentary investigation into his dealings.

In 2023, short-seller firm Hindenburg Research accused the Adani Group of stock price manipulation and fraud, leading to a sharp decline in the company's market value by $68 billion. The Adani Group denied these allegations, asserting that it has complied with all regulations and local laws.

Adani's immense wealth and controversial rise have made him a polarizing figure, with supporters pointing to his strategic investments in critical sectors as a way to align with national priorities.

This article contains additional reporting from The Associated Press

)

English (US) ·

English (US) ·