According to new survey data collected by the Bermuda Monetary Authority (BMA), Bermuda-based insurance and reinsurance company’s made increased use of industry-loss warranties (ILW’s), quota share arrangements and retrocession in 2023.

The Bermuda financial market regulator each year publishes its stress test results and an assessment of catastrophe risk exposure in the local insurance and reinsurance market, showing how dynamics change in use of capital and risk transfer by the islands re/insurers.

Noting the “the Bermuda market’s relatively high concentration of Catastrophe (Cat) risk,” Ricardo Garcia, Managing Director, Supervision at the BMA, said that, “(re)insurers saw significant improvements to profitability in 2023, largely driven by lower levels of high-severity catastrophes despite catastrophe losses globally estimated to exceed US$100 billion. The precise impact of climate change on the frequency and severity of catastrophic events is still uncertain although data indicates that secondary perils, such as floods and wildfires, drove catastrophe losses in recent years. Bermuda (re)insurers benefited from increased retentions, restricted coverage, and restructured programmes to control premium budgets.”

The BMA’s report goes on to state, “Overall, the 2023 Cat Risk Return and Schedule of Risk Management (together ‘Cat Return’) results show that the gross loss exposure assumed by Bermuda insurers increased by 2.69%, from $199.11 billion in 2022 to $204.51 billion in 2023. Furthermore, the value of global gross estimated potential loss assumed by Bermuda insurers from the major Cat perils (combined) has increased from $180.14 billion in 2022 to $184.75 billion in 2023; the Bermuda market maintained 23% of the global market share year-over-year. After a hardening of the market in 2022, the Cat exposure assumed by the Bermuda market remained steady in 2023.”

Ceded losses declined year-on-year, falling -2.64% to $118.49 billion.

With the hard reinsurance and retrocession market came higher attachments for protection and Bermuda’s market has been as affected as any other location in the world.

The BMA’s report states, “The BMA also assesses the level of insurers’ reliance on reinsurance and/or other loss mitigation instruments for each peril. Overall, the aggregate loss impact results show that the level of reinsurance reliance (gross loss ceded) decreased by about 2.63% compared to last year and varied across each peril. This is in comparison to the slight increase in the aggregate loss impact and indicates that insurers, on balance, retained more in 2023.

“On average, insurers ceded about 57.9% of gross losses in 2023, compared to 61.1% in 2022.”

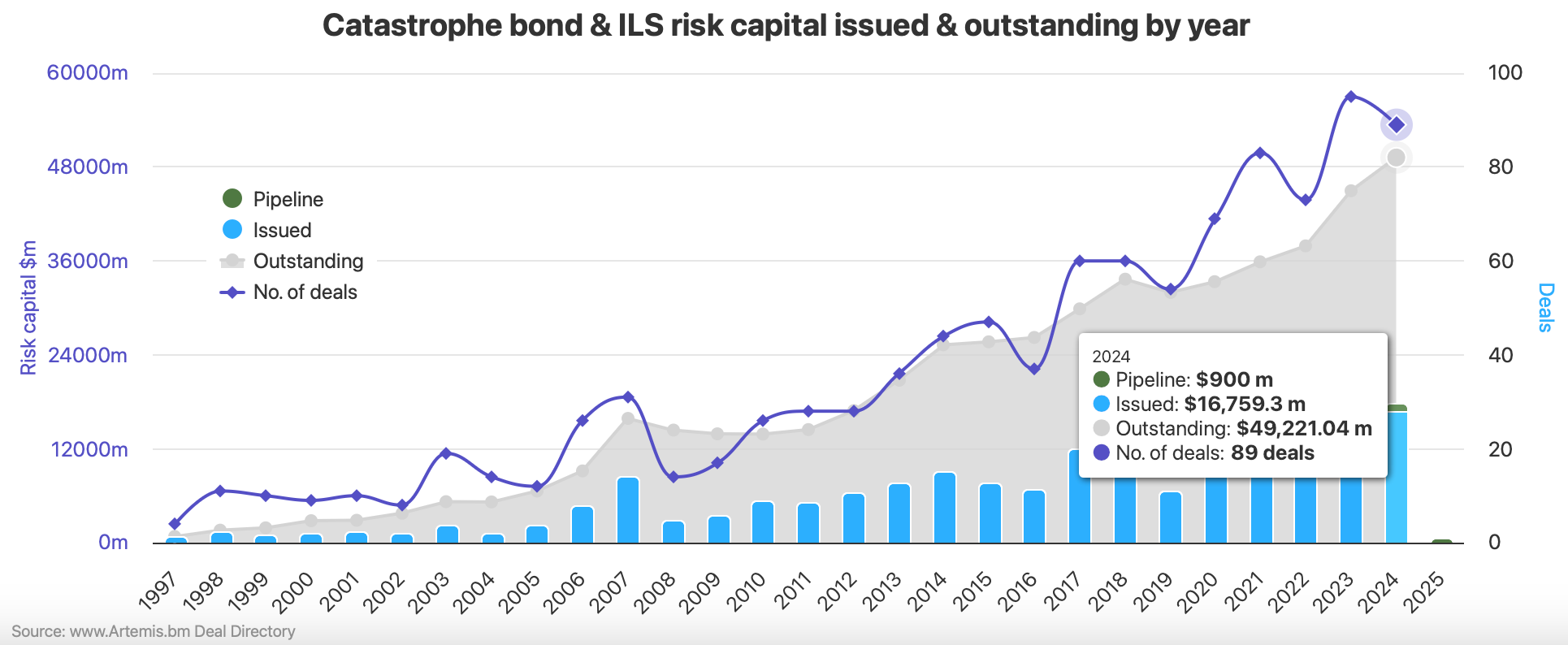

When it comes to use of reinsurance and risk transfer tools, traditional and insurance-linked securities (ILS) or capital markets supported, there are once again some changes to the mix that Bermuda’s re/insurers utilised in 2023.

The BMA said, “Bermuda insurers use various reinsurance methods to cede some of their catastrophe exposure, which can include traditional property catastrophe contracts, quota share contracts, insurance-linked securities protection and industry loss warranties contracts. Compared to last year, purchases of property catastrophe contracts dropped by 25%, whereas quota share contracts increased by 26%. This indicates a shift in how losses are ceded, potentially with

the aim of bringing risk profiles into closer alignment.”

As we’ve been tracking the BMA’s reports for a number of year’s now, we’ve laid out the results of its question where the regulator asks about re/insurers use of risk capital for protection and the types of reinsurance structures they adopted each year.

As you can see the use of insurance-linked securities (ILS) reduced in 2023, compared to the prior year, but it remains generally higher than it was back in 2020.

Notable increases are seen in the use of industry-loss warranty (ILW) contracts for hedging in 2023, as well as in the use of retrocession and quota share arrangements, while property cat contract use saw the biggest decline.

It reflects a market adjusting to cope with hardened pricing, higher retentions and also even availability issues for certain types of risk transfer through 2023.

It will be interesting to compare again in a year’s time, when the 2024 figures are available and we should see a pattern that looks like reinsurance and risk transfer conditions were still hard, but perhaps more accommodating with ILS use potentially increasing.

English (US) ·

English (US) ·