QBE, the Australia headquartered global insurance and reinsurance group, is now targeting reduced pricing for its first catastrophe bond sponsorship since 2013, with the spread guidance now lowered for the $250 million Bridge Street Re Ltd. (Series 2025-1) issuance, we understand.

QBE returned to the catastrophe bond market earlier this month, as we first reported on December 12th, targeting $250 million or more in retrocession from this Bridge Street Re 2025-1 deal.

QBE returned to the catastrophe bond market earlier this month, as we first reported on December 12th, targeting $250 million or more in retrocession from this Bridge Street Re 2025-1 deal.

It will be QBE’s first cat bond sponsorship since late 2013, when it secured $250 million of US and Australian multi-peril protection from the VenTerra Re Ltd. (Series 2013-1) deal.

The goal remains for Bridge Street Re to issue $250 million of Series 2025-1 Class A notes to provide QBE with a multi-year source of retro reinsurance protection, on an industry-loss trigger and annual aggregate basis.

The coverage will run across a roughly three-year term, from issuance to the end of 2027, protecting QBE against major named storm and earthquake industry loss events throughout the United States, Puerto Rico, DC, the US Virgin Islands and Canada.

The $250 million of Class A notes Bridge Street Re Ltd. will issue come with an initial expected loss of 1.29% and were intiially offered to cat bond investors with price guidance in a range from 4.25% to 5%.

We’re now told that the price guidance for the risk interest spread the notes will pay has been reduced to between 4% and 4.25%.

As a result, QBE looks set to benefit from investor demand and strong execution for its first catastrophe bond since 2013, with these notes looking likely to be priced at the bottom of the initial guidance or below it.

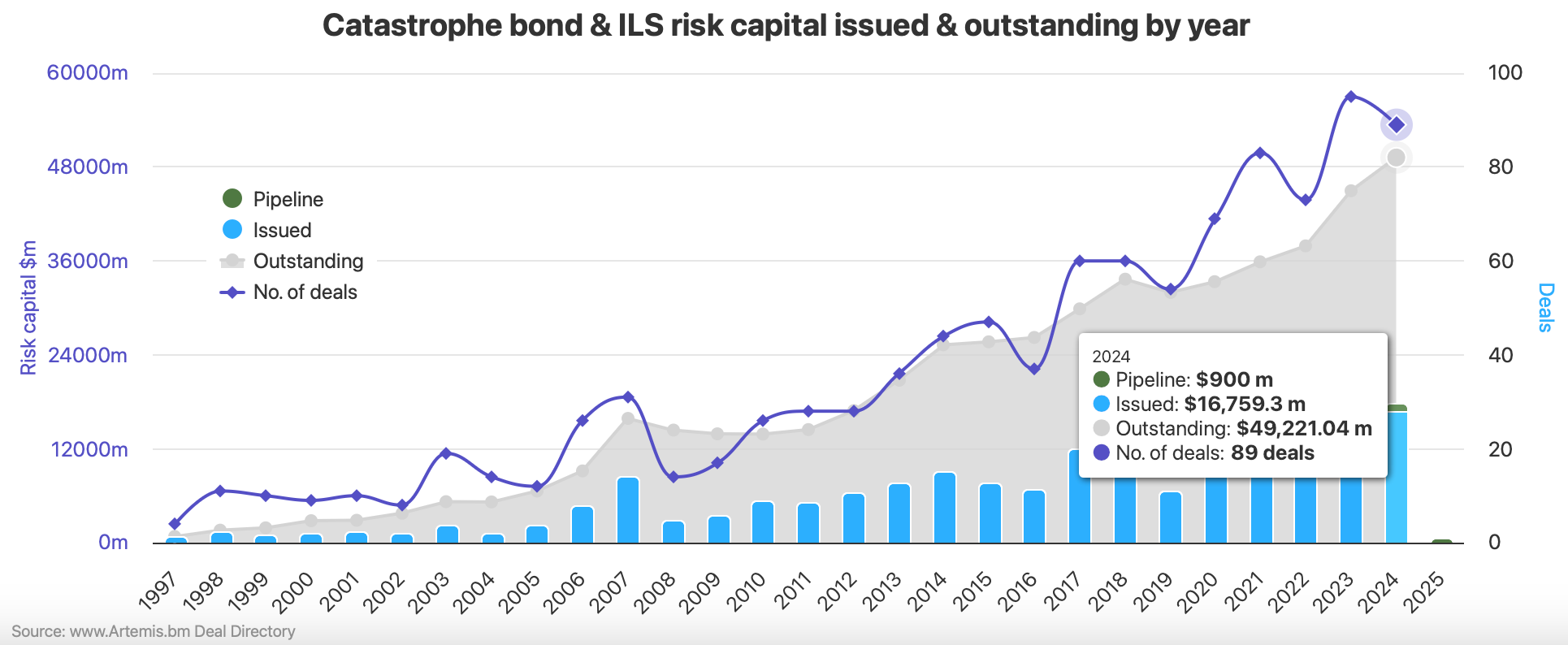

You can read all about this new Bridge Street Re Ltd. (Series 2025-1) catastrophe bond transaction and every other cat bond ever issued in our Artemis Deal Directory.

English (US) ·

English (US) ·