Here are the ten most popular news articles, week ending December 22nd 2024, covering catastrophe bonds, ILS, reinsurance capital and related risk transfer topics. To ensure you never miss a thing subscribe to the weekly Artemis email newsletter updates or get our email alerts for every article we publish.

Ten most read articles on Artemis.bm, week ending December 22nd 2024:

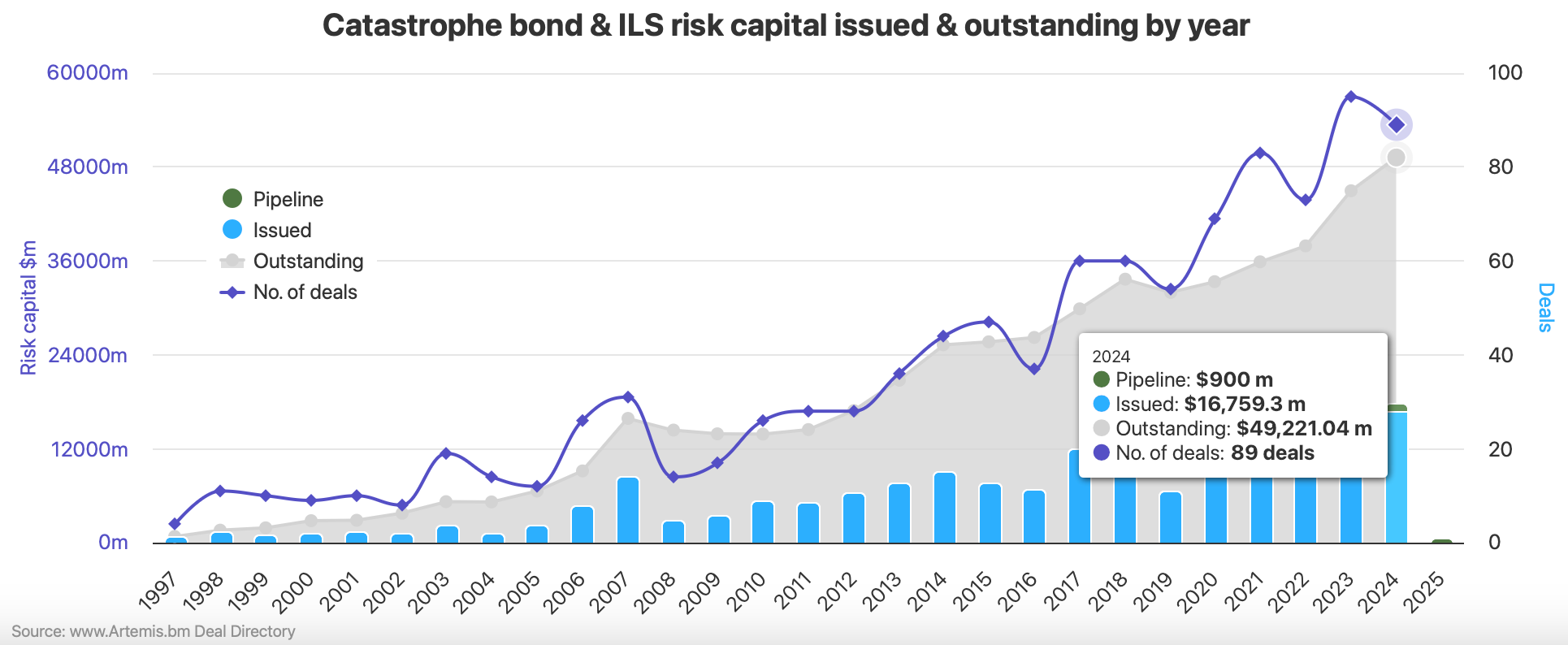

- Cat bond issuance breaks all records in 2024. Market grows 10% to $49.44bn

Catastrophe bond market records are falling in 2024 and set to be beaten on most fronts, with overall issuance recorded in the Artemis Deal Directory reaching a new high of almost $17.7 billion for the year, including a record $17.24 billion of Rule 144A cat bonds, driving a new end-of-year outstanding market record and cat bond market growth of 10%. - Pagnani & Manghnani launch ILS manager King Ridge. Will portfolio manage first cat bond ETF

King Ridge Capital Advisors LLC has been launched as a new insurance-linked securities (ILS) investment manager by sector specialists Rick Pagnani and Vijay Manghnani, Artemis understands. We’ve learned that the new company has already reached a sub-advisory agreement to take on portfolio management duties for the awaited first catastrophe bond ETF. - Florida State Board set to increase ILS allocations at January renewals for FRS pension

Having previously indicated that it was cautious on reinsurance market conditions and undecided as to whether to add to its insurance-linked securities (ILS) investments for the January 2025 renewals, the Florida State Board of Administration now appears set to move forwards and increase its allocation to the sector. - TD Insurance seeks first ever pure Canada risk cat bond, C$150m MMIFS Re 2025-1

TD Insurance, part of Canada’s TD Bank group, is seeking C$150 million in reinsurance from the capital markets through its debut MMIFS Re Ltd. (Series 2025-1) catastrophe bond deal, which would be the first natural cat bond to solely cover perils in that country. - Liberty Mutual secures $325m Mystic Re IV catastrophe bond at reduced pricing

Liberty Mutual has now secured the upsized target of $325 million of fully collateralized reinsurance protection through its new Mystic Re IV Ltd. (Series 2025-1) catastrophe bond, while the insurer benefited from high investor demand and strong cat bond execution to price the deal largely below initial guidance. - Lockton sets up Global Parametric Insurance Practice

Lockton, the independent insurance and reinsurance broking group, has announced the formal launch of a new Global Parametric Insurance Practice, bringing together its parametric risk transfer expertise under one specialist unit. - ECB, EIOPA propose EU nat cat reinsurance solution, with catastrophe bond support

A proposal published by the European Central Bank (ECB) and the European Insurance and Occupational Pensions Authority (EIOPA) calls for a natural catastrophe insurance system that includes pooling private risks, strengthening disaster risk management, and the use of catastrophe bonds to support catastrophe reinsurance availability for Europe. - J.P. Morgan / Coutts liquid alts fund adds catastrophe bonds, with up to 10% permitted

A multi-manager liquid alternatives investment fund strategy managed by J.P. Morgan and offered to clients through a partnership with British private bank and wealth manager Coutts & Co. has updated its investment policy to allow up to 10% of the strategies assets to be allocated to catastrophe bonds. - Colorado looking to catastrophe bonds for wildfire risk transfer

According to reports, the US state of Colorado is exploring whether catastrophe bonds may be a suitable risk transfer mechanism to help it deal with growing wildfire related risks and address insurance affordability. - Aon poll: 15% of US insurers say ILS / third-party capital feature in their 2025 plans

A recent poll of insurers in the United States, undertaken by broker Aon’s Capital Advisory division, found that within those carriers’ capital management plans for 2025, insurance-linked securities (ILS) and third-party reinsurance capital solutions are a significant feature.

This is not every article published on Artemis during the last week, just the most popular among our readers over the last seven days. There were 31 new articles published in the last week.

To ensure you always stay up to date with Artemis and never miss a story subscribe to our weekly email newsletter which is delivered every Wednesday.

View the current breakdown of the ILS market in our range of charts, allowing you to analyse cat bond issuance.

Check out the assets under management of the ILS fund market with our ILS investment manager directory.

Get listed in our MarketView directory of professionals.

English (US) ·

English (US) ·