Analysts at Keefe, Bruyette & Woods (KBW) are the second group to say that the returns generated from catastrophe reinsurance risk underwriting and capital allocation can remain strong, just so long as the industry remains disciplined on attachments, terms and conditions.

It’s taken a while for it to become clearer that the real driver of the last two years of catastrophe reinsurance profitability has been the elevated attachment points and stricter terms installed, not just the higher pricing achieved.

It’s taken a while for it to become clearer that the real driver of the last two years of catastrophe reinsurance profitability has been the elevated attachment points and stricter terms installed, not just the higher pricing achieved.

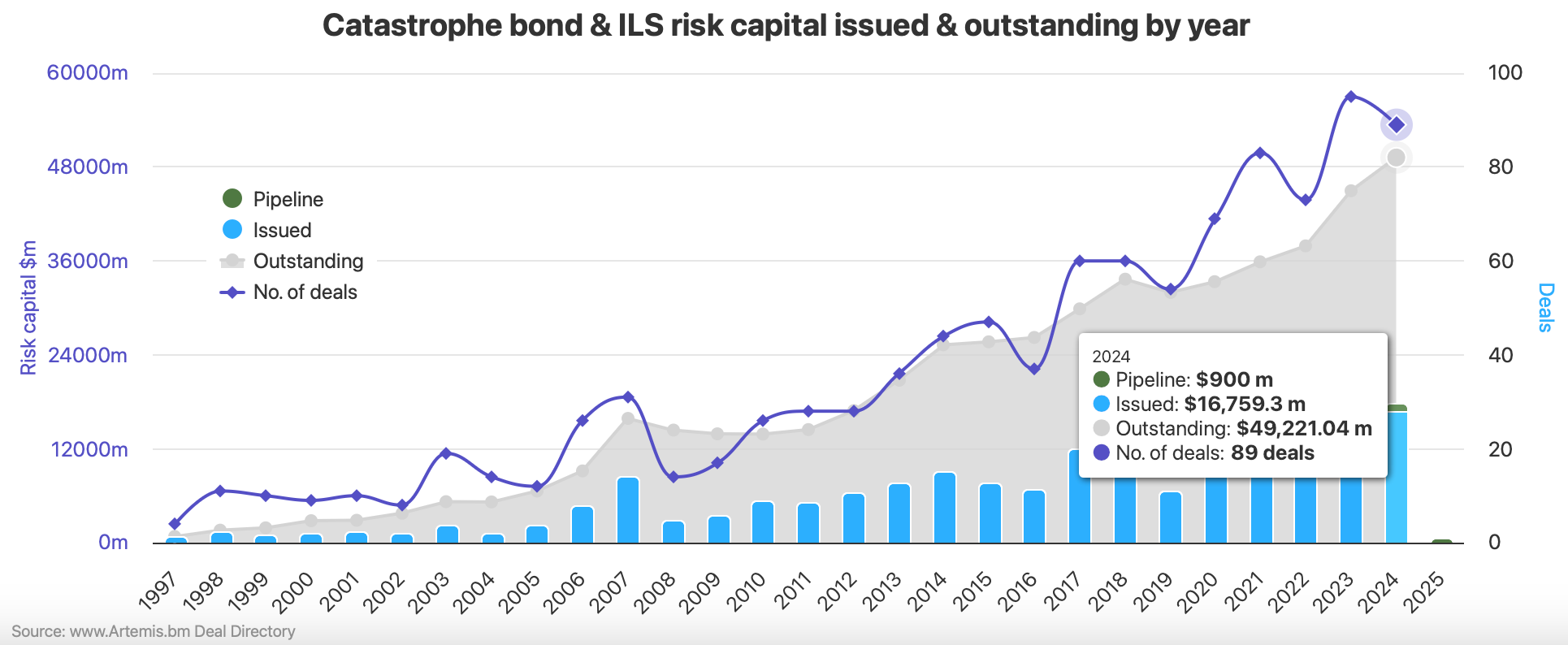

In fact, the catastrophe bond market is a case in point here, where recent tightening of spreads and yields has not been as negatively received as one would have seen a few years ago.

The reason being, that the insurance-linked securities (ILS) investor community is comfortable with the level in the reinsurance tower where cat bonds currently sit, as the instrument has now moved away from frequency and back to the peak catastrophe peril coverage it had originally been designed for.

For traditional reinsurance firms the same holds true, with those operating at higher-layers more accepting of declining rates-on-line at the January 2025 renewals, as some price is given back while the T&C’s of coverage remain largely sticky.

KBW’s analyst team said, on all-important underwriting margins, “We expect sustained strong catastrophe reinsurance profitability, mostly reflecting stable terms and conditions, dampened by overall rate decreases.

“Quota share-focused casualty reinsurance profitability should improve given earned premium (i.e., rate and exposure unit) growth and some ceding commission decreases.”

Declining reinsurance costs will read across to better profitability for primary insurers as well, which is perhaps making them more comfortable at the thought of another year of elevated retentions.

Of course, the secret here is in finding the right-balance, between retention and cession, to enable both primary and reinsurance tiers of the market to sustain profits in average catastrophe loss years, while still having responsive protection in-place for those years where elevated catastrophe losses eat into or erode profits.

Catastrophe loss ratios, for primary P&C carriers, are not expected to change, given “unchanging reinsurance attachment points and still-high secondary peril frequencies,” but lower reinsurance costs will certainly help the primary side of the marketplace and ease some pressure seen in recent years, KBW explained.

Florida may be an outlier on reinsurance price, given hurricane and storm losses, although evidence from recent Florida focused catastrophe bonds suggests there might be some softening here as well.

KBW’s analysts said, “We expect modest rate decreases during the January 2025 reinsurance renewals but modest increases during the Florida-heavy (and hence more loss-impacted) June 2025 renewals.”

Adding to the chance of a more profitable primary sector are underwriting actions implemented in the last two years, which may begin to flow to the bottom-line more evidently.

On the property catastrophe reinsurance equilibrium, KBW’s analysts state, “The higher property catastrophe reinsurance attachment points implemented in 2023 created a clear divergence in underwriting results, with primary insurers bearing most of the last two years’ catastrophe losses while reinsurers’ results have improved markedly. We believe the growing frequency of billion-dollar convective storms (which accounted for about 75% of global insured natural catastrophe losses in 1H24 and 59% in 2023, according to Aon’s September 2024 “Ultimate Guide to the Reinsurance Renewal” report) validates the reinsurers’ decision to limit their exposure to secondary (i.e., other than hurricane and earthquake) perils, and we don’t expect the reinsurers to compromise on that change even if rates decline somewhat.”

Assuming a reasonably normalised catastrophe loss experience in 2025, KBW’s analysts say, “we expect reinsurers to generate solid returns in 2025.”

But, while price is seen as more important than attachments and terms, in defining the probability of reinsurance remaining profitable, there will be a limit and the market will need to wait and see how the weight of capital builds and what effect it has on rates over the next year.

English (US) ·

English (US) ·