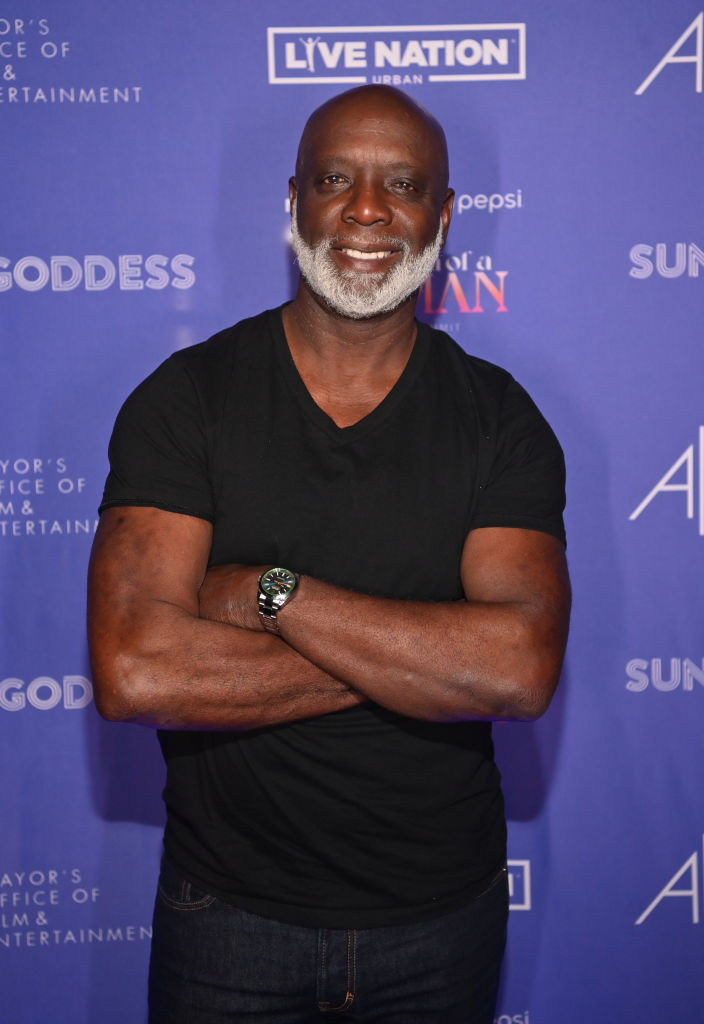

Peter Thomas received a final verdict in his tax fraud case, and the outcome was far from favorable. On Dec. 18, the 64-year-old entrepreneur and former Real Housewives of Atlanta star was sentenced to 18 months in prison after pleading guilty to tax fraud, according to PEOPLE.

Source: Raymond Boyd / Getty

Surprisingly, Thomas expressed that he was “grateful” for the judge’s “fair” decision in a video posted to Instagram on Dec. 19.

“I am grateful and I’m going to remain grateful,” he told fans.

Before he turns himself in, Thomas said he will be given time to get “some of his business affairs done” – a gesture that he claimed was “beyond nice” of the judge and prosecutors.

In addition to serving time behind bars, the founder of the now-defunct Bar One Miami, Bar One Baltimore, and Sports One Bar and Lounge in Charlotte will be required to pay $2.5 million in restitution and complete two years of supervised release.

Source: Prince Williams / Wireimage

A Snapshot Of Thomas’ Financial Troubles.

Thomas’ tax troubles began in 2019 when it was revealed that Sports One Bar and Lounge in Charlotte, North Carolina, was over $237,000 in debt, which led to a federal tax lien. Initially, he planned to close the business temporarily, pay off the debt, and then reopen. However, the process proved more complicated than he had anticipated, and additional debts from his other businesses began to accumulate.

According to a report by The Baltimore Banner, a federal prosecutor’s memo shed light on the extent of Thomas’ financial difficulties. The memo revealed that between 2017 and 2023, “Thomas caused Club One CLT, Sports ONE, Sports ONE CLT, PT Media, Bar One Miami Beach, and Bar One Baltimore to fail to pay over $2,526,131.99 in employment taxes, including more than $1,740,000 in trust fund taxes from the wages of his employees.”

Instead of paying off the huge tax debt, Thomas allegedly spent nearly $375,000 on travel and ride-sharing services, in addition to dropping $250,000 on high-end luxury items from brands like Neiman Marcus, Prada, Louis Vuitton, and Givenchy, the memo claimed.

“Thomas’s flagrant violation of his federal payroll tax obligations over many years that served to unjustly enrich his companies and himself by more than $2.5 million and deprive the federal government funds used to provide important retirement and disability benefits to employees.”

The sentencing memo described Thomas as being driven by “greed,” stating he violated tax laws while expanding his business and increasing costs, neglecting his legal obligations.

“Americans can spend their money as they see fit, including on business ventures. However, they cannot steal other people’s money—in this case their employees’ payroll taxes—to prop up their otherwise failing business ventures,” the memo added, according to The Baltimore Banner.

Thomas Offered Advice Business Owners —Pay Your Withholding Taxes!

On the day of his sentencing, Thomas used Instagram to issue a stern warning to small business owners, advising them to pay their withholding taxes.

“I’ll be making an appearance in the United States government federal courthouse here in Charlotte, North Carolina, to face the music,” he told his followers on Dec. 18. “The music of … consistently withholding taxes for [my] businesses [for] over 10 years.”

He continued:

“I thought it was something that I could rectify by getting on that payment plan and paying it. But it doesn’t work like that. I plead guilty and with my plea of guilty I have to sit down for a while.”

In the caption, Thomas penned:

“Public announcement, most people are confused when it comes to paying withholding taxes, I am here to set the record straight, yes you will go to jail, [yes] you still have to pay the taxes,” he wrote. “Also, jail don’t mean that the taxes is forgiven. All young business owner[s], please learn from my mistake.”

What do you think about Peter Thomas’ tax fraud verdict? Tell us in the comments section.

English (US) ·

English (US) ·