Here are the ten most popular news articles, week ending November 10th 2024, covering catastrophe bonds, ILS, reinsurance capital and related risk transfer topics. To ensure you never miss a thing subscribe to the weekly Artemis email newsletter updates or get our email alerts for every article we publish.

Ten most read articles on Artemis.bm, week ending November 10th 2024:

- French terror pool GAREAT sponsoring €100m Athéna I Re catastrophe bond

GAREAT, a co-reinsurance pool created for the ceding of compulsory terrorism insurance cover provided in France, has entered the catastrophe bond market for the first time, seeking €100 million or more in terrorism reinsurance from the capital markets from an Athéna I Reinsurance DAC issuance. - Berkshire Hathaway pegs hurricane Milton loss at $1.3bn-$1.5bn, Helene at $565m

The insurance and reinsurance businesses of Warren Buffett’s Berkshire Hathaway suffered from hurricane losses in the third-quarter with Helene and are expecting up to $1.5 billion of additional losses from hurricane Milton in the fourth-quarter. - 144A property cat bond issuance nears $12.8bn, hits second-highest level ever

Already in 2024, the dollar amount of new Rule 144A property catastrophe bonds issued and settled has reached the second-highest level on record, according to completed property cat bond deals tracked in the Artemis Deal Directory so far this year. - APRA looks to enhance Australian insurer access to ILS and cat bonds for reinsurance

Recognising that regulations hinder access to alternative reinsurance solutions including insurance-linked securities (ILS) in the country, the Australian Prudential Regulation Authority is consulting with industry, as participants there want easier access to solutions such as catastrophe bonds. - Catastrophe bond funds in UCITS format grow share of market to 27%

Having continued to expand their assets under management in recent months, UCITS catastrophe bond funds as a group have now grown their share of the overall cat bond market to a new high, at 27% of risk capital supplied. - Disciplined 1/1 renewal expected, but attachments not expected to reduce: AIG CEO

AIG CEO Peter Zaffino explained today that he anticipates property catastrophe reinsurance renewals at January 1st 2025 will be disciplined, but he is not expecting reinsurers to lower attachment points for insurers. - Talanx seeks debut Maschpark Re cat bond, for parametric LatAm quake reinsurance

Talanx AG, the German insurance and reinsurance group, has entered the catastrophe bond market for its debut transaction, seeking $100 million or more in parametric Latin America earthquake protection through this Maschpark Re Ltd. (Series 2024-1) issuance. - Enstar in second property ILS legacy acquisition. ILS a growth opportunity, says CEO

Enstar, the legacy and run-off reinsurance specialist, has announced completion of its second legacy transaction focused on property insurance-linked securities (ILS), acquiring a Bermuda based Class 3B reinsurer that underwrote business on behalf of third-party investors. - Chard Re promotes Orendorf to Chief Underwriting Officer

Chard Re, a reinsurance-linked investment manager run by well-known industry executives Rick Montgomerie and Charlie Vaughan, has promoted team member William (Bill) Orendorf to the role of Chief Underwriting Officer (CUO). - HNW investor demand for alternatives “growing exponentially” – Brookfield Oaktree

High-net-worth investors want to deploy more capital to alternative asset classes, while they also desire a greater variety of alternative investment products as well, believing that adding alternatives to their portfolios can drive stronger long-term outcomes, data from Brookfield Oaktree Wealth Solutions suggests.

This is not every article published on Artemis during the last week, just the most popular among our readers over the last seven days. There were 38 new articles published in the last week.

To ensure you always stay up to date with Artemis and never miss a story subscribe to our weekly email newsletter which is delivered every Wednesday.

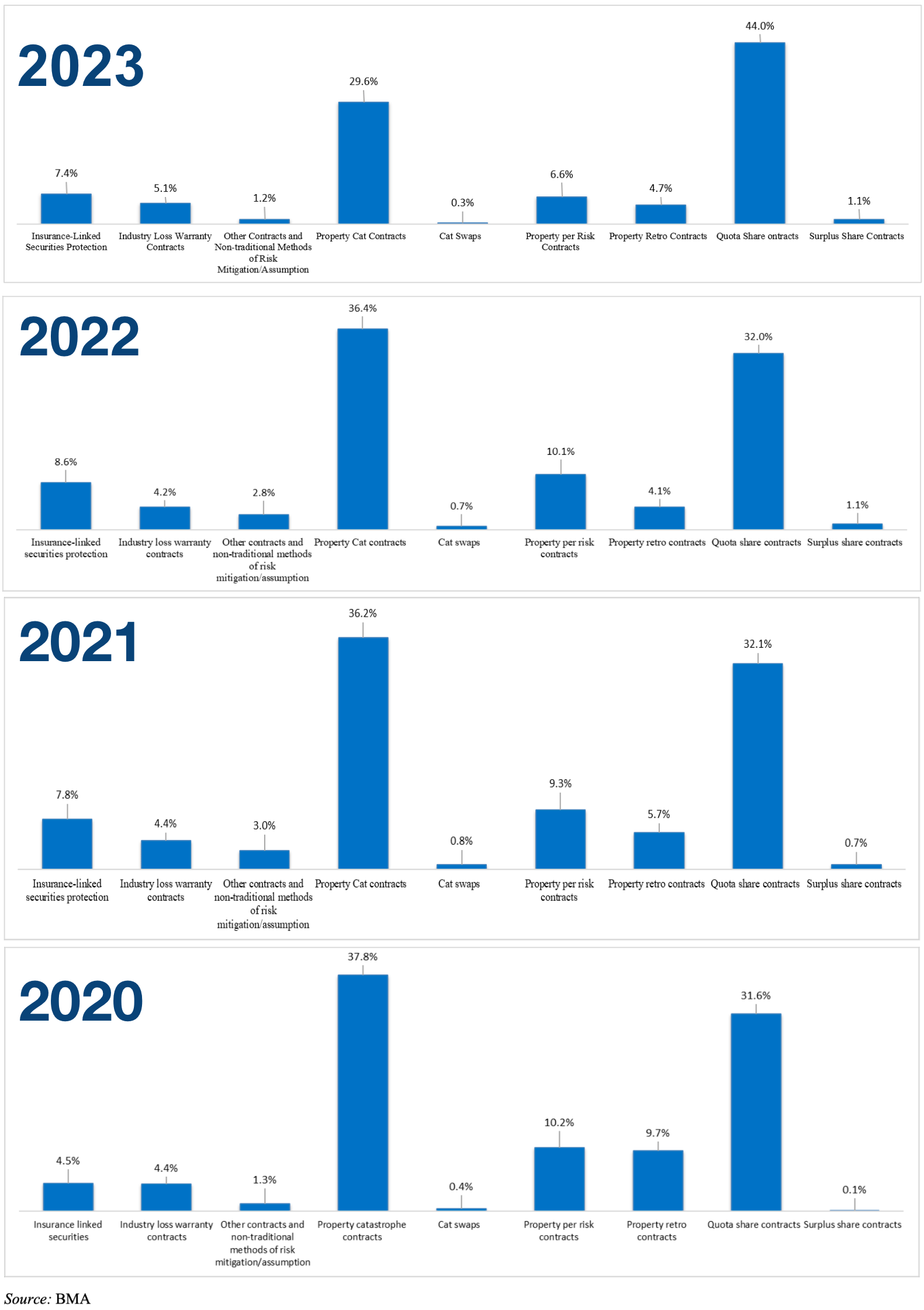

View the current breakdown of the ILS market in our range of charts, allowing you to analyse cat bond issuance.

Check out the assets under management of the ILS fund market with our ILS investment manager directory.

Get listed in our MarketView directory of professionals.

English (US) ·

English (US) ·